Trump’s Tariffs: The Game-Changer for the US Tech Industry?

2025-04-03

Author: Ming

Introduction

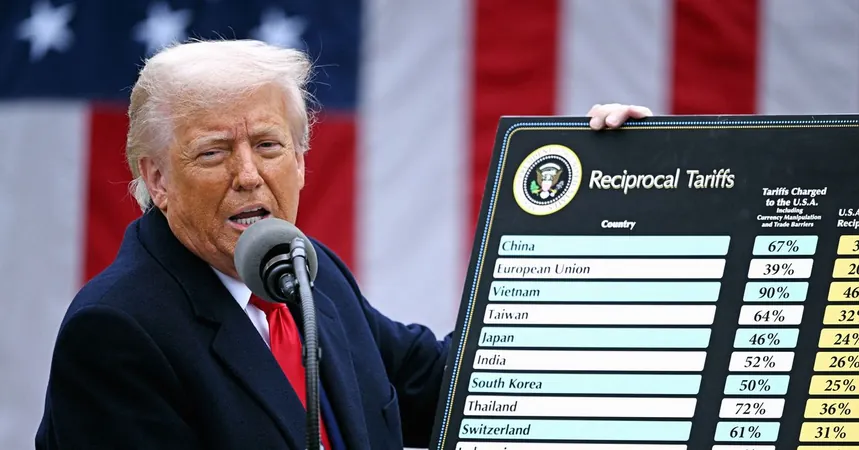

In a bold move on Wednesday, US President Donald Trump introduced sweeping tariffs that could dramatically alter the landscape of the American tech industry. Experts warn that these new regulations, which impose a minimum 10 percent tariff on virtually all imports, alongside hefty duties on key trading partners such as Europe, China, Vietnam, India, and South Korea, may send shockwaves through financial markets and consumer prices alike.

Impact on Tech Stocks

Following the announcement, major tech stocks plummeted. According to CNBC, shares of Meta and Nvidia each dropped around 5 percent, while tech giants like Apple and Amazon saw declines of approximately 6 percent. This downturn comes as Apple generates nearly half of its revenue from products manufactured in China and India, with many of Amazon's third-party goods also sourced from these countries.

Concerns Over Inflation

Economists are raising red flags about the potential for these tariffs to usher in a new era of inflation, with Goldman Sachs increasing the likelihood of a US recession to 35 percent in the next year, up from 20 percent. "Consumers may not be as willing to absorb higher costs for American-made products as some believe," points out Tibor Besedes, a trade expert at Georgia Tech. "With many Americans having voted for Trump out of frustration over inflation during the Biden era, they likely won't welcome rising prices now."

Tariff Variations by Country

While the tariffs vary significantly by country—lower rates for the UK, Chile, and Brazil, and much higher rates for nations like China, Taiwan, and India—Trump has temporarily exempted a crucial component: semiconductors. Companies like Nvidia, reliant on chips manufactured by Taiwan Semiconductor Manufacturing Company (TSMC), are currently shielded from new tariffs that could impact their products significantly. However, the future of these exemptions remains uncertain, particularly concerning the blanket 10 percent tariff.

E-commerce Sector's Burden

The e-commerce sector may bear the brunt of these tariffs. Ian Bremmer, a well-known political scientist, emphasizes that online retailers and consumer electronics brands will experience operational strains. Trump also ended the de minimis exemption, which allowed American consumers to import goods valued under $800 from China and Hong Kong without incurring duties. This loophole, beneficial to e-commerce giants like Shein and Temu, is also vital for platforms like eBay and Etsy.

Logistics Opportunities

Some companies, particularly those in logistics and data analytics, may see opportunities in these turbulent times. Ram Ben Tzion, CEO of a digital shipment vetting platform, speculates that cutting the de minimis may act as leverage in negotiations with China, fundamentally transforming American online shopping.

Silver Lining for Logistics Companies

Despite the chaos that tariffs create, there is a silver lining. For logistics companies like Nuvocargo, demand for their services has surged as they navigate the complex landscape of border crossing regulations. Still, the unpredictability of tariffs has caused confusion and financial strain for importers.

Long-term Economic Outlook

Nick Vyas, director of the Global Supply Chain Institute, acknowledges that these tariffs, if employed thoughtfully, could ultimately benefit the US economy by reducing over-reliance on foreign manufacturing. He advocates for a strategic approach that includes building infrastructure for semiconductor manufacturing and enhancing local labor forces through apprenticeship programs. However, there is an urgent need for a clear and stable trade policy that fosters collaboration with global allies.

Conclusion

As the tech industry grapples with these changes, one thing is clear: Trump's tariffs are not just a tax but a potential catalyst for a fundamental shift in how the US engages with global trade and manufacturing. Will this upheaval lead to a renaissance in domestic production, or will American consumers bear the brunt of rising prices? Only time will tell.

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

Česko (CS)

Česko (CS)

대한민국 (KO)

대한민국 (KO)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)

الإمارات العربية المتحدة (AR)

الإمارات العربية المتحدة (AR)