Trump's Tariff Gamble on Imported Medicines: A Dangerous Political Play

2025-04-15

Author: Jessica Wong

President Trump's recent move towards imposing tariffs on imported medicines is stirring up political tensions, as it risks hiking drug prices and creating severe shortages for many Americans.

On Monday, the Trump administration launched a federal investigation to assess if importing medicines poses a threat to national security. This could lay the groundwork for potential tariffs on foreign-produced drugs, a strategy Trump has hinted at repeatedly.

However, experts caution that imposing tariffs is unlikely to result in the desired shift of manufacturing back to the U.S. The logistics of moving production overseas is not only costly but could take years to implement.

The timeline for the investigative process remains unclear, but Trump hinted these tariffs could be rolled out soon, expressing concern over America's reliance on foreign nations for pharmaceuticals.

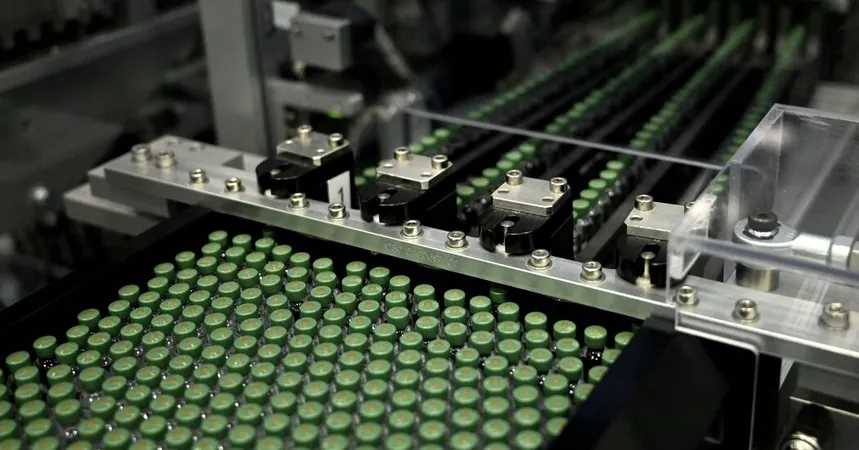

"We don’t make our own drugs anymore," Trump asserted, pointing fingers at companies that have relocated production to countries like Ireland and China.

For years, the U.S. has relied heavily on China for pharmaceuticals, raising flags across the political spectrum. Even major players in India’s generic drug industry, which supplies a significant amount of medications to the U.S., depend on Chinese materials.

Unlike previous tariff actions in sectors like steel, which did not directly affect consumer prices, these pharmaceutical tariffs could lead to serious backlash. If drug prices surge or shortages occur due to these tariffs, Trump might find himself in hot water, especially with midterm elections looming.

In a bid to alleviate drug costs, Trump signed an executive order on Tuesday aimed at facilitating the importation of cheaper drugs from Canada. However, proposed tariffs may thwart these savings.

Democrats are ready to seize on any uptick in drug prices, potentially using it as ammunition against Trump’s standing among working-class voters.

Experts warn that disruptions in the drug supply could have alarming consequences, including rationing by healthcare providers and even jeopardizing patient lives. The stakes are higher than ever with last year marking a record in drug shortages.

White House spokesman Kush Desai defended the initiative, emphasizing the need for reshoring critical manufacturing to bolster national security.

Yet, targeting pharmaceuticals could further strain relations with allies such as the EU and India, which rely on exports to the U.S. There are fears that this might deter investments, leading to job losses in their countries.

Pharmaceuticals represent one of America’s highest import categories, and any tariffs could flood the industry with increased costs, complicating the already intricate global supply chain.

The higher costs from tariffs would predominantly impact generic medications, which are critical for the majority of U.S. prescriptions. As manufacturers grapple with razor-thin margins, higher tariffs may force them to cut production or cease operations altogether.

In contrast, brand-name drugs are expected to handle tariff costs more easily due to higher profit margins, but even they may see price adjustments.

Furthermore, patients facing deductibles may end up shelling out more out-of-pocket expenses. Any changes in pricing could ripple through health insurance premiums in the coming years.

Despite promises from industry leaders like Eli Lilly's CEO to absorb tariff costs, the reality remains that cutbacks on research and development or staffing could be on the horizon.

While Trump touts tariffs as a means to entice drug manufacturers back to American soil, experts assert that it’s not the solution. Building new facilities or shifting production is an uphill battle exacerbated by costs associated with U.S. labor.

Industry leaders have emphasized that effective solutions lie in tax policy rather than tariffs alone. As the Trump administration eyes Ireland—home to many U.S. drugmakers benefiting from low tax rates—the quest for reshoring continues to pose significant challenges.

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

Česko (CS)

Česko (CS)

대한민국 (KO)

대한민국 (KO)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)

الإمارات العربية المتحدة (AR)

الإمارات العربية المتحدة (AR)