Trump’s Policies Trigger Stock Market Shift … in Global Markets!

2025-03-16

Author: Ting

In a shocking twist since his inauguration, President Trump’s promise of American exceptionalism seems to be having an unintended impact on the stock market. Rather than leading U.S. markets to new heights, investors are increasingly reallocating their funds to overseas markets, where growth appears more promising.

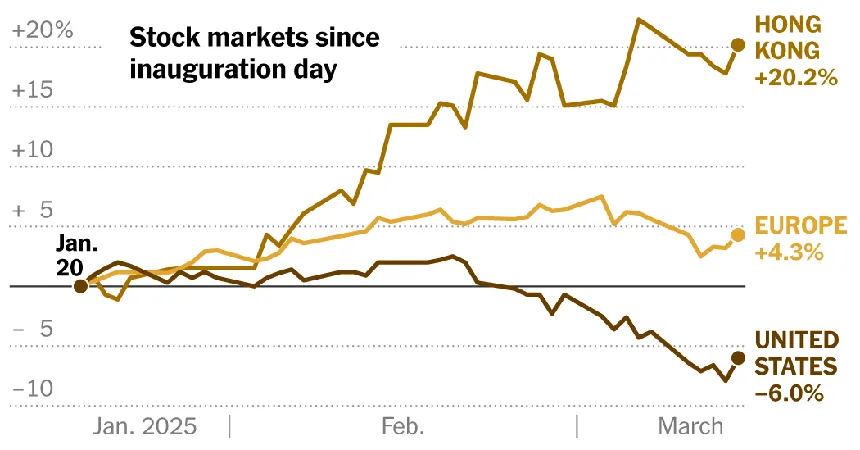

Since Trump took office, the S&P 500 has experienced a 6% decline, while Europe’s DAX index has surged by 10% and the Europe-wide Stoxx 600 has increased by over 4%. The malaise besetting U.S. indexes stands in stark contrast to the robust performance of markets in Asia and Europe, as political uncertainties and tariff threats have investors on edge.

The Hang Seng Index in Hong Kong has seen an impressive rise of over 20%, propelled by China's economic stimulus efforts, while Mexico's IPC index has climbed 5% despite the challenges posed by Trump’s aggressive tariff policies. Analysts attribute this shift in investor sentiment to rising military expenditures in Europe, encouraged by Trump's insistence that NATO countries boost their defense spending.

Investment advisors are now advocating for a broader global investment strategy. "It is definitely time to be looking at ex-U.S.," noted Jitania Kandhari, the deputy chief investment officer at Morgan Stanley Investment Management. The recent trends indicate a growing interest among clients for international equities, as U.S.-listed stocks face headwinds from ongoing policy uncertainties.

Adding to the narrative, a recent report indicated that foreign investment withdrawals from U.S. stocks had begun, with investors pulling out $2.5 billion in just one week—marking the first significant downtrend this year. This comes in sharp contrast to the nearly $100 billion influx seen at the start of 2023, which had fueled the prolonged dominance of U.S. markets.

Brokers and market strategists are aware that the shift may not happen overnight. As Greg Boutle of BNP Paribas pointed out, some institutional investors like pension funds take time to adjust their portfolios. The real concern is that if the trend of pulling money from U.S. stocks continues, it could exacerbate downward pressure on the S&P 500, which recently fell into correction territory, defined as a drop of over 10% from its peak.

Despite these challenges, many investors remain optimistic about the long-term potential of U.S. equities, citing historical advantages over foreign markets. As Paul Christopher of Wells Fargo Investment Institute noted, “I think eventually all of this uncertainty settles down and we will still be left with a U.S. that has advantages that Europe and other countries don’t have.”

However, speculation is rising over whether this moment could signal a significant shift in the long-standing trend of U.S. market supremacy. With European nations ramping up government spending—largely driven by a response to geopolitical threats—the situation remains fluid, and many are watching closely whether this will lead to sustainable economic growth or merely a temporary response to crises.

As investors weigh their options, the global financial landscape is becoming increasingly contentious. Will American exceptionalism prevail once again, or are we witnessing the dawn of a new era in investment strategies? The coming months will be crucial as major global markets adjust to a rapidly changing economic environment spurred by evolving U.S. policies.

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

Česko (CS)

Česko (CS)

대한민국 (KO)

대한민국 (KO)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)