The Unexpected Ripple Effect of Trump's Tariffs on American Consumers

2025-07-31

Author: Ken Lee

Trump's Trade Bombshell: What You Need to Know

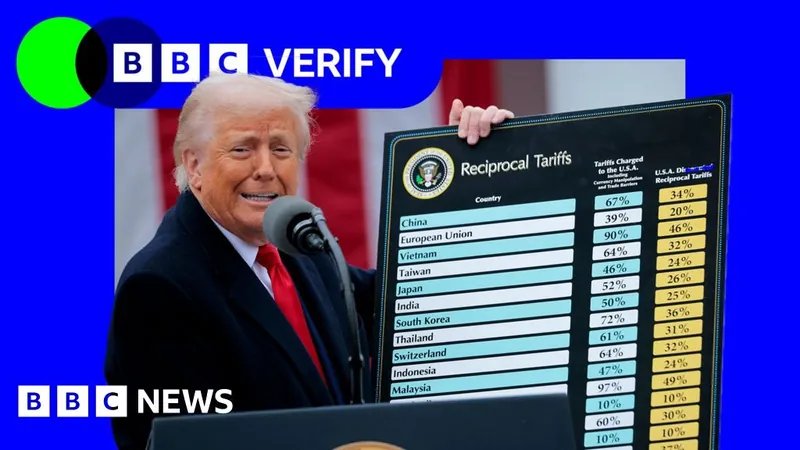

Since his return to the White House, President Donald Trump has turned the global trading landscape on its head with new, aggressive tariffs. Announced on April 2, dubbed Liberation Day, these steep import taxes target several countries and industries.

Tariff Impact: The Price Tag for Americans

Even though some tariffs have been paused and Trump has brokered deals to lower certain rates with countries like the UK and Japan, the effects are looming large. Specific industries, notably automotive and steel, face unprecedented tariffs. The U.S. is currently seeing the highest average tariff rates in nearly a century.

Surprisingly, it's U.S. companies importing these goods that bear the brunt of these tariffs, impacting the economy in numerous ways.

A Surge in Tariff Revenue: Who's Benefiting?

According to the Budget Lab at Yale University, the average effective tariff rate rocketed to 18.2% by mid-2025, a vast leap from just 2.4% in 2024. This surge is translating to significant increases in tariff revenues for the U.S. government — with June 2025 marking a staggering $28 billion in collections, three times more than the previous year.

While the revenues appear beneficial, the Congressional Budget Office warns that these tariffs could ultimately harm the overall U.S. economy and not offset the significant losses from Trump’s tax cuts over the coming decade.

Trade Deficits: The Irony Behind Tariffs

In a bold move to rectify what Trump sees as an unfair trade imbalance, the tariffs have ironically widened the U.S. trade deficit. Rather than curtail imports, U.S. firms stockpiled to dodge the impending taxes, causing goods imports to soar and exports to rise only slightly.

The trade deficit hit a record $162 billion in March 2025 before easing to $86 billion in June, but experts remain skeptical about any long-term fixes as the underlying economic imbalances persist.

China's Response: A Shift in Trade Dynamics

China was a primary target of Trump’s tariffs, which once reached as high as 145%. Although now reduced to 30%, the strains have led to an 11% drop in exports to the U.S. during 2025's first half. In contrast, China has found new trading partners, with exports to countries like India and those in the ASEAN bloc increasing.

Global Trade Realignments: New Alliances Forming

Trump’s trade strategies have prompted nations to seek new alliances rather than retaliate with tariffs of their own. For example, the UK and India finalized a trade pact after three years of negotiations, while other countries are exploring similar agreements to bolster their economies amid shifting global dynamics.

With the U.S.-China agricultural trade waning, China is pivoting towards Brazil for soybean imports, showcasing the broader ramifications of Trump’s tariff strategy.

Rising Prices: What This Means for American Consumers

As economists brace for impact, it’s clear that Trump's tariffs will lead to increased costs for American consumers. The inflation rate edged up to 2.7% by June 2025, with signs emerging of rising prices in imported goods like appliances and electronics. Retailers managed to hold off price hikes for a while, but the rising costs are now becoming apparent.

Researchers are finding that imported and tariff-affected goods are experiencing inflation rates faster than non-tariffed products, indicating that consumers may soon feel the heat at the checkout counter.

Conclusion: The Complex Web of Trade and Economy

As Trump’s trade policies continue to unfold, their true cost to American consumers and businesses becomes clearer, creating an intricate web of economic consequences that could shape the U.S. economy for years to come. Stay tuned, as this story is far from over.

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

Česko (CS)

Česko (CS)

대한민국 (KO)

대한민국 (KO)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)

الإمارات العربية المتحدة (AR)

الإمارات العربية المتحدة (AR)