The Looming Credit Score Crisis: How Delinquent Student Loans Could Impact Millions in 2025

2025-03-26

Author: Wei

The Looming Credit Score Crisis: How Delinquent Student Loans Could Impact Millions in 2025

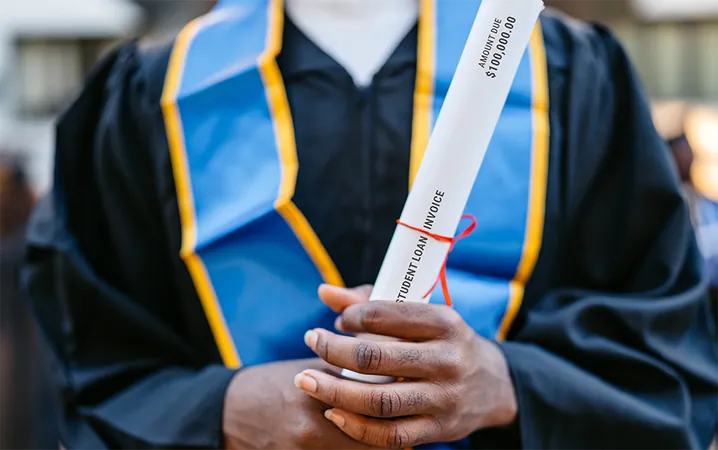

As we prepare to face significant changes in the economy and lending landscape, it's vital to understand how overdue student loan payments can drastically affect credit scores. Recent analyses reveal that more than nine million student loan borrowers are on the verge of facing substantial declines in their credit ratings as delinquencies hit credit reports in early 2025.

The Positive Impact of Pandemic Policies

The temporary forbearance enacted during the pandemic had profound effects on borrowers' credit scores. Data from the New York Federal Reserve indicated a remarkable 11-point rise in median credit scores among student loan borrowers from the end of 2019 to the end of 2020, especially for those who had previous delinquencies. For instance, borrowers who had fallen behind saw their median scores jump significantly—from 501 to 575—after their loans were provisionally marked as current.

While the initial pandemic relief helped many, the resumption of payments in 2024 could spell disaster for those who failed to catch up on missed payments, potentially forcing their scores to plummet again.

Shadow Delinquencies: A Hidden Burden

As the first quarter of 2025 approaches, reports predict a significant spike in the delinquency rates of student loans as borrowers with missed payments fall over 90 days past due. Estimates suggest that the "shadow delinquency rate" has surged, with over $250 billion in delinquent debt impacting nearly 9.7 million borrowers.

The impending figures reveal a concerning reality: borrowers who previously held positive credit ratings now face the risk of severe consequences that could last for years. As missed payments get reported, these ratings could fall by an average of 171 points for those with superprime credit scores (those over 760) and 87 points for subprime scores (those below 620).

What This Means for Borrowers

The potential for such sharp declines in credit scores raises alarm bells for millions. While some borrowers may be able to recover by catching up on payments or entering administrative forbearance plans, the damage inflicted by a new delinquency can linger on credit reports for up to seven years. This long-term impact can severely restrict access to credit, make securing loans more difficult, and result in higher interest rates.

Furthermore, if credit-deteriorating trends are felt mostly by prime borrowers, the overall effect on the credit market could be drastic—leading to tighter lending standards and a potential ripple effect throughout the economy.

Final Thoughts

The looming threat of increasing student loan delinquencies poses a serious challenge for borrowers and credit markets alike. As early 2025 approaches, the financial impacts of overdue student loans must not be overlooked. With the bad news on the horizon, individuals must begin strategizing on how to navigate this credit crisis, whether through communication with lenders, exploring alternative repayment options, or seeking financial counseling.

Stay tuned as we continue to monitor the evolving landscape of student loans and credit scores in the coming months. It's a crucial time to understand and prepare for the potential fallout. Don’t let your financial future be compromised—take action now!

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

Česko (CS)

Česko (CS)

대한민국 (KO)

대한민국 (KO)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)

الإمارات العربية المتحدة (AR)

الإمارات العربية المتحدة (AR)