The Impact of Banning Medical Debt from Your Credit Reports: What You Need to Know!

2025-01-07

Author: Yan

In a significant move, the Biden administration has officially banned credit reporting agencies from factoring in medical debt when calculating credit scores. This policy change aims to mitigate the financial burdens faced by millions of Americans, making it easier for them to secure loans and mortgages. Vice President Kamala Harris stated, “No one should be denied economic opportunity because they got sick or experienced a medical emergency,” emphasizing the administration’s commitment to financial equity.

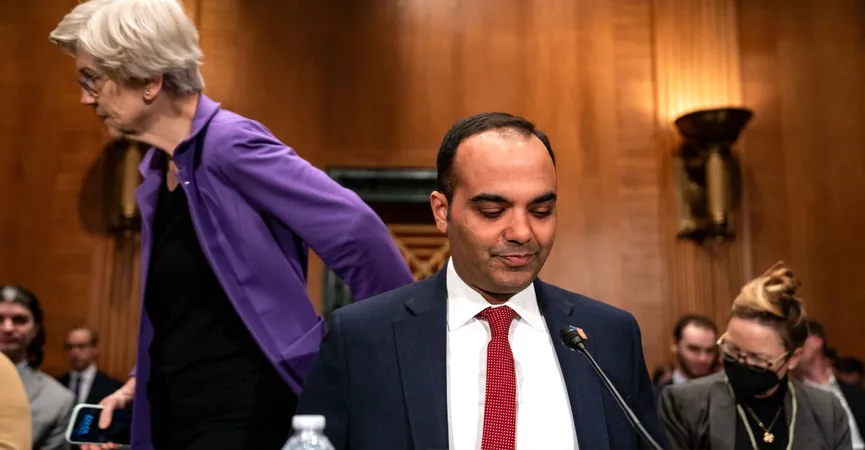

This groundbreaking rule, finalized by the Consumer Financial Protection Bureau (CFPB), emerged from a proposal made back in June 2024. It is seen as part of an ongoing series of reforms aimed at alleviating the crushing weight of medical debt—an issue that has plagued Americans for years. While advocates herald this change as a victory, questions linger about its actual impact and the potential for political pushback.

How Medical Debt Reporting Works

The mechanics of medical debt reporting involve the discretion of individual healthcare providers on whether to report unpaid debts to credit bureaus. This reporting not only influences credit scores but also affects borrowers’ chances to obtain loans. In 2023, notable credit agencies like TransUnion, Experian, and Equifax already began excluding medical debt below $500 from credit assessments, which was a precursor to this new ban.

According to the CFPB, this rule is estimated to erase nearly $49 billion in medical charges from the credit histories of around 15 million Americans. Research suggests medical debt is often an inaccurate reflection of a person’s overall creditworthiness, as many individuals report financial issues stemming from billing errors or unanticipated insurance deficiencies.

Positive Economic Shifts Expected

Economists suggest that removing medical debt from credit reports could meaningfully boost individuals' credit scores, particularly for those with no significant debt outside of medical bills. Research indicates that those who had their medical debts removed might see their credit scores rise by an average of 14 points, which could translate to an increased borrowing capacity of about $900.

Experts like Francis Wong, an economist at Ludwig Maximilian University of Munich, argue that this policy will encourage people to pursue necessary medical care without the apprehension of jeopardizing their credit ratings. Eva Marie Stahl from Undue Medical Debt concurs, noting that the fear of reported medical debt may deter individuals from accessing crucial health services.

Challenges Ahead & Political Resistance

Despite the potential positives, experts also voice caution about the overall efficacy of this rule. While it benefits those with minimal debts, many still face ongoing medical issues and financial struggles due to the initial medical events that incurred the debt. This raises a persistent challenge: even if medical debts are absent from credit reports, the debts remain, continuing to affect individuals' financial stability and access to care.

As the Biden administration winds down, a Republican-controlled Congress could pose significant challenges to this policy. Some Republican leaders have questioned the rule's efficacy, arguing that it undermines lending practices and could inflate risks for the financial system, potentially making borrowing more difficult for all.

Conclusion: A Double-Edged Sword

The prohibition of medical debt in credit reporting opens doors for many individuals seeking financial relief, yet it does not entirely resolve the persistent issues tied to medical costs. With an evolving political landscape and ongoing debates around healthcare and financial reform, the final ramifications of this rule remain to be seen. It’s a pivotal moment for millions seeking relief from the harsh realities of medical debt that has long affected their financial choices. Will this change lead to sustained economic opportunity, or will it face significant rollback efforts? Only time will tell!

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

Česko (CS)

Česko (CS)

대한민국 (KO)

대한민국 (KO)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)

الإمارات العربية المتحدة (AR)

الإمارات العربية المتحدة (AR)