The $100 Billion Tariff Enigma: Where's the Inflation?

2025-07-13

Author: Kai

A bewildering economic conundrum is unfolding as mainstream economists and political factions assert that tariffs primarily burden consumers. Despite warnings from businesses that they would pass on tariff costs, the anticipated wave of tariff-driven inflation has yet to materialize.

In fact, the U.S. Treasury has amassed an astonishing $100 billion in customs duties thus far, with projections soaring to $300 billion for the year. These tariffs, applied when goods enter the U.S. — especially affecting giants like Walmart — should typically lead to increased consumer prices, influencing overall inflation rates.

Yet, the inflation figures tell a different story, with recent reports showing inflation rates hovering at a mere 2.4%, much less than expected.

Why Are Tariffs Not Affecting Prices?

Leading economists offer several insights to unravel this inflation mystery. First, they argue that the tariffs are still too new to have a definitive effect on prices. The National Taxpayers Union noted that key tariffs were only implemented in mid-April, and the official price data takes time to compile.

Businesses Stockpiling Goods

In a rush to avoid higher tariffs, many importers stockpiled goods before the new rates took effect, leading to an inventory surplus that has yet to impact prices significantly. Eric Winograd, chief U.S. economist at AllianceBernstein, explained that this stockpile allows businesses to maintain prices because they are still selling goods acquired under pre-tariff conditions.

Uncertainty in Pricing

Moreover, uncertainty looms large over future pricing strategies. Businesses are hesitant to adjust their prices without clear knowledge of how much higher replacement costs will be. This hesitation has kept many companies from increasing their prices, despite higher costs coming down the pipeline.

Smaller Businesses Bearing the Costs

Small businesses might also be absorbing some tariff costs to retain customers, fearing that passing on these costs could lead to lost sales. Recent data suggests that small businesses are feeling the pinch, with a significant increase in tariff payments reported.

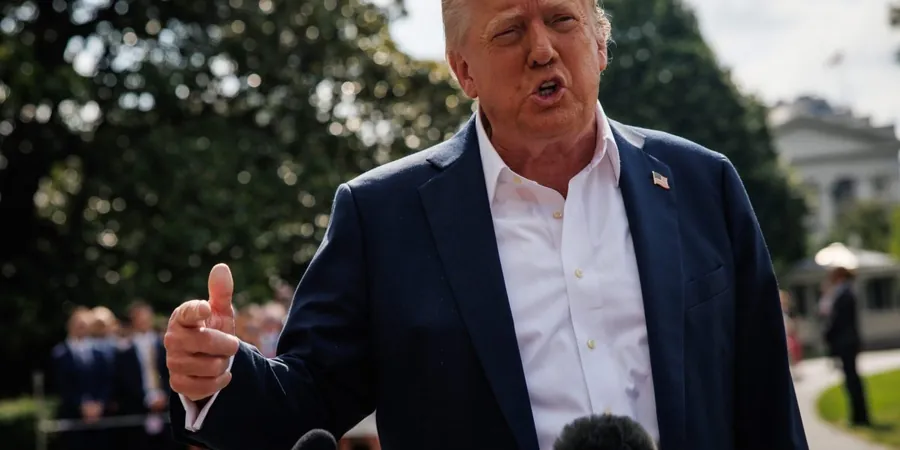

The Trump Factor

The looming presence of Trump has also played a role, as businesses are wary of potential backlash for raising prices. Economic analysts speculate that if the visible pass-through of tariffs results in noticeable consumer price hikes, public policy reactions could follow swiftly.

Consumer Spending on the Decline

With consumer inflation hitting new heights in recent years, people are now tapped out after spending their pandemic savings. This new reality is causing businesses to tread cautiously when considering price increases, mindful that aggressive pricing could alienate cash-strapped consumers. Leading economists agree that the landscape has shifted, and companies are no longer as quick to raise prices as they were during the pandemic surge.

Could Inflation Never Come?

Some economists suggest we may never see significant inflation from these tariffs. Mark DiPlacido from American Compass noted that many foreign manufacturers, such as Japanese automakers, are absorbing a large portion of tariff costs, sometimes cutting prices to offset increases.

This scenario highlights that tariffs can create a complex interplay between importers, exporters, and consumers, leading to differing outcomes across various sectors of the economy. The ultimate impact of tariffs will depend on many factors, including specific industries and broader economic conditions.

In conclusion, as the $100 billion mystery unfolds, it is clear that the relationship between tariffs and inflation is intricate, and the eventual outcome remains uncertain.

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

Česko (CS)

Česko (CS)

대한민국 (KO)

대한민국 (KO)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)

الإمارات العربية المتحدة (AR)

الإمارات العربية المتحدة (AR)