Tesla’s Stock Slide: Why One Key Investor Predicts Even More Declines!

2025-03-13

Author: Lok

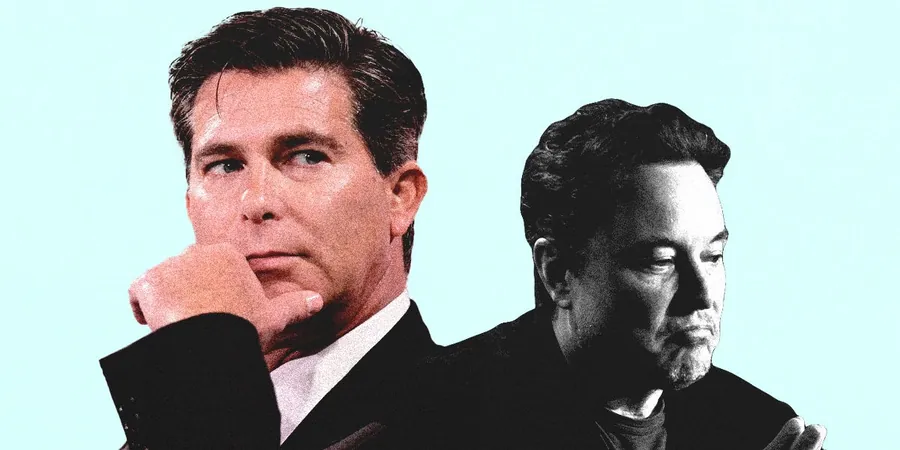

In a stunning turn of events, early Tesla investor Ross Gerber has shifted from being a bullish supporter to a bearish skeptic as he makes a daring prediction about Tesla's future. Just months ago, he forecasted a jaw-dropping 50% drop in Tesla’s stock by 2025, and the numbers have been staggering—Tesla shares have already plummeted 31% since then.

With a long history of investing in Tesla, Gerber, who is also the president and CEO of Gerber Kawasaki Wealth & Investment Management, is sounding alarm bells again. While Tesla's stock has nosedived a staggering 48% since reaching its peak in mid-December, Gerber deems the current price point still too high for him to invest further.

During a recent interview, he expressed his concerns about the tech giant’s stock performance, stating he sees 'no clear path for rebounding this year.' Gerber, whose firm manages around $3 billion, significantly reduced their Tesla stake by 31% in 2024, leaving him with 262,000 shares valued at $106 million at last year’s end.

So, what needs to happen for Tesla to rebound? According to Gerber, it’s simple: earnings must rise significantly. He calculated a potential price target of $250 per share based on future earnings, but he expressed doubt, mentioning, 'They have no path to that.' Tesla’s earnings per share plummeted 52% to $2.04 in 2024, with projections suggesting slight improvements in the coming years—$2.75 for 2025 and $3.65 for 2026. However, these estimates are now under scrutiny due to a shaky economic climate and waning sales across the globe.

Moreover, Gerber attributes part of the trouble to CEO Elon Musk's controversial political antics, which he believes have alienated a segment of Tesla's customer base. His critique included references to Musk's provocative gestures that drew unwarranted comparisons, stating that such actions have put a stamp on Tesla's brand image.

Despite a recent downturn, Gerber insists that Tesla remains overly valued, with shares trading at a staggering 65 times forward price-to-earnings ratio—far higher than the average valuation of the S&P 500. He finds this completely unjustifiable, especially when investors can secure other tech stocks, like Nvidia, at significantly lower valuations and with promising earnings growth.

As the automotive market evolves, Gerber warns of a 'used-car problem' for Tesla. He likens Tesla’s quality to Apple's, where the longevity and durability of vehicles reduce the incentive for consumers to upgrade regularly. With many looking to sell their older EVs and finding themselves caught in falling values, Tesla’s direct sales are becoming less appealing to cost-conscious buyers.

As the used car market turns increasingly unfavorable for lower demand and high-quality products, Gerber raises serious concerns: 'Unless the hardware dramatically outpaces previous versions, people won’t feel the need to upgrade in this inflationary environment.'

As Tesla navigates these daunting challenges, investors and fans alike are left wondering: Will this electric titan recover, or is it on a path to further decline? Keep an eye on Tesla’s stock for what could be one of the most pivotal years in its history!

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

Česko (CS)

Česko (CS)

대한민국 (KO)

대한민국 (KO)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)

الإمارات العربية المتحدة (AR)

الإمارات العربية المتحدة (AR)