Tesla Shares Plummet Amid Tariffs and Brand Turmoil: What You Need to Know!

2025-04-07

Author: Jessica Wong

Tesla's stock took a significant nosedive on Monday, following a drastic reduction of its price target by prominent analyst Dan Ives at Wedbush Securities. Citing a "perfect storm" precipitated by President Trump's new auto tariffs and CEO Elon Musk's problematic public image, Ives slashed the target from $550 to $315, while still maintaining an "outperform" rating.

The electric vehicle giant saw its shares drop more than 9% initially, hitting a low of $216 before closing the day at $233.29, marking a 2.5% loss for the session. This downward trend has been alarming for investors, as Tesla's stock has plunged nearly 40% since the start of the year and fallen a staggering 55% from its record high achieved last December.

The turbulence began earlier this year when, following Trump's victory in the presidential election, the market initially rallied, optimistic about Musk's supposed alignment with the new administration. However, the sentiment soon soured as Musk's controversial ties to Trump fostered a "brand crisis" for Tesla. Once-admirable attributes like environmental advocacy have been overshadowed by mounting dissent towards Musk’s involvement in the political sphere.

Ives pointed out that the backlash against Musk, coupled with the political symbol Tesla has inadvertently become, has resulted in a loss of about 10% of its potential customer base worldwide, with notable ramifications in China, where tariffs have incited further discontent among consumers. Public protests against Tesla have ensued, with some incidents even involving vandalism of the company’s vehicles and charging stations.

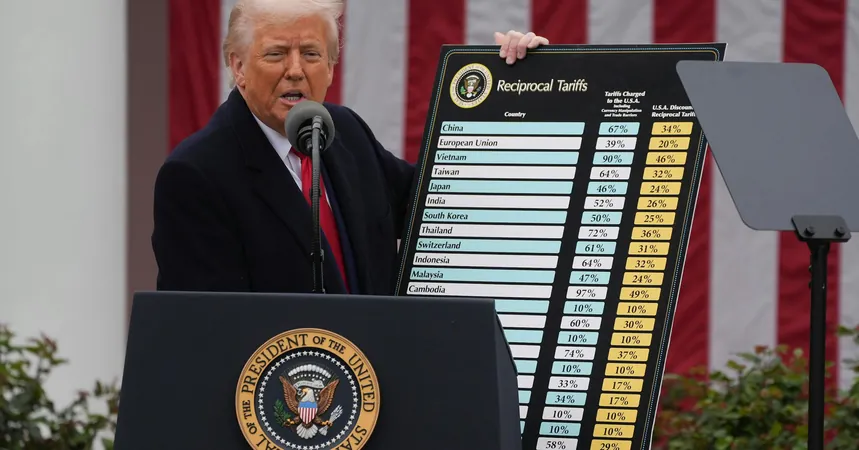

The implications of Trump's auto tariffs extend beyond Tesla, as these measures promise to disrupt supply chains and escalate vehicle pricing. While Tesla may not be as severely affected as traditional automakers like Ford and Stellantis, it still relies on various imported parts and battery components, which could exacerbate its current financial troubles.

Recent reports revealed that Tesla managed to deliver 336,681 vehicles in the first quarter—significantly below the industry expectations of 400,000—indicating that the ripple effects from the tariff crisis are more pronounced than anticipated.

But not all news is bleak for Tesla. Ives remains hopeful about the company's future innovations, particularly its ongoing advancements in autonomous driving technology and the potential launch of a robotaxi service. He believes these developments could help stabilize and eventually boost Tesla's market performance.

As for the broader tech sector, it too has faced challenges since the announcement of new tariffs, with market leaders like Apple seeing their stock price plummet—down approximately 19% since the tariffs were introduced. Investors have been rattled by fears of inflated production costs, which could similarly affect companies like Meta, involved heavily in advertising in China.

With stock prices remaining volatile amid speculation over a potential pause to the tariffs—a claim the White House has dismissed—the tech landscape is at a pivotal moment. On Monday, major players saw mixed performance, with Apple's shares closing down 3.6%, while others like Meta and Alphabet experienced slight gains.

In conclusion, Tesla is grappling with a dual crisis of market forces and brand image, a situation that will require adept navigation from Musk and his team if they hope to reclaim investor confidence and stabilize the company's future. Will Tesla overcome this "perfect storm"? Only time will tell!

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

Česko (CS)

Česko (CS)

대한민국 (KO)

대한민국 (KO)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)

الإمارات العربية المتحدة (AR)

الإمارات العربية المتحدة (AR)