S&P 500 Soars to Unprecedented Heights as Earnings Surge and Inflation Fears Fade

2025-01-23

Author: Ting

Introduction

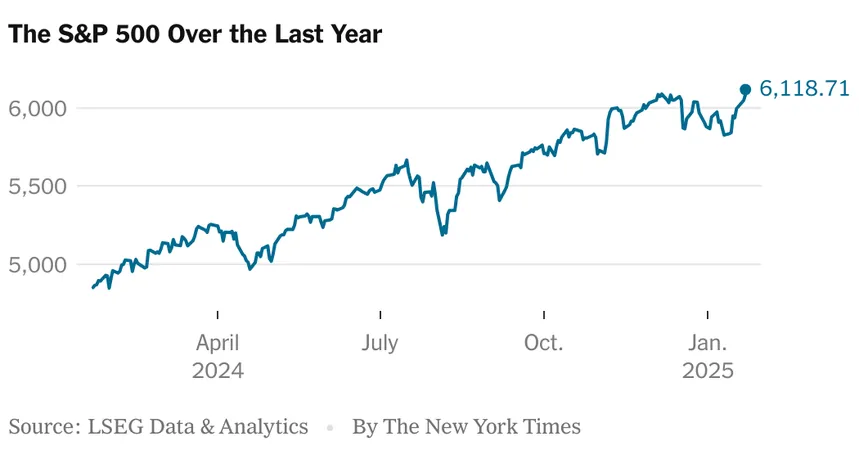

In an exciting turn of events for investors, the S&P 500 has soared past its previous all-time high, showcasing a remarkable recovery that has left many analysts buzzing. On Thursday, the index climbed by 0.5 percent, setting a new record since its peak in early December. This rally kicked off due to a significant easing of inflation concerns, bolstered further when President Donald J. Trump expressed his determination to reduce oil prices—a crucial factor in the inflation equation.

Market Performance

Analysts noted that the S&P 500's ascent is impressive, with a 4 percent gain already recorded in just three weeks of the new year. Investors are heartened by recent data depicting a slowdown in inflation in December, which surpassed economists' expectations. This renewed optimism comes after a rather dismal period where volatility and inflation fears had stifled market growth.

Initial Anxieties and Recent Trends

Despite initial anxieties regarding the inflationary consequences of Trump’s proposed policies—including new tariffs and an aggressive approach to immigration—recent trends indicate a turnaround. Wall Street was particularly worried that such policies might lead the Federal Reserve to maintain higher interest rates longer than anticipated, a scenario typically unfavorable for stock valuations. However, the release of positive inflation data has alleviated much of that worry.

Investor Confidence Boost

Additionally, during the World Economic Forum in Davos, Trump pledged to "bring down the cost of oil," further enhancing investor confidence. In a response to this announcement, West Texas Intermediate crude oil prices slipped over 1 percent, settling at $74.62 per barrel.

Bond Market Dynamics

In the bond market, the dynamics have shifted as well, with the two-year Treasury yield—closely tied to interest rate forecasts—slipping lower. Although the 10-year Treasury yield increased slightly on Thursday, it has significantly decreased over the past week, marking a trend that supports the recent equity market rally. Lauren Goodwin, an economist at New York Life Investments, describes this yield movement as instrumental to shifts in the equity market this week.

Tariff Implementation and Market Reactions

Interestingly, investors have found comfort in the Trump administration's paced approach to tariff implementation and immigration policies. Although Trump indicated plans for a 25 percent tariff on Canadian and Mexican imports and a 10 percent tariff on Chinese imports, these measures are expected to roll out only in February, alleviating immediate worries for market participants.

Market Resilience

David Kelly, chief global strategist at J.P. Morgan Asset Management, remarked that the market’s resilience stems from the fact that many "worst fears have not been realized."

Corporate Earnings Surge

The surge in stock valuations is also fuelled by a slew of positive corporate earnings reports. Netflix, for instance, saw its stock climb nearly 10 percent after reporting unprecedented subscriber growth in the last quarter of 2023. Meanwhile, General Electric shares jumped around 6.5 percent following a robust earnings performance that exceeded market expectations. Analysts predict that earnings for S&P 500 companies will grow by over 12 percent compared to the fourth quarter of 2022, potentially marking the best quarter for corporate profits since late 2021.

Caution Signals

However, caution signals linger in the air: investment inflows into U.S. stock funds have slowed, and a recent Deutsche Bank measure has shown a dip in investor ownership of stocks to a two-month low. With the S&P 500 having achieved a staggering 20 percent growth in 2023 and early 2024, some experts warn that the rally may have reached overzealous heights, particularly among large tech companies that now significantly dominate the market.

Conclusion

As the market continues to navigate these dynamic changes, investors remain hopeful—will the S&P 500 keep climbing, or is a correction on the horizon? Only time will tell. Stay tuned to find out how this captivating story unfolds!

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

Česko (CS)

Česko (CS)

대한민국 (KO)

대한민국 (KO)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)