S&P 500 Insights: Major Gains and Surprises as Broadcom Surges on Stellar AI Earnings

2024-12-13

Author: Ling

Summary of Market Performance

In a somewhat mixed day for U.S. equities, the stock market wrapped up the trading week with some key economic indicators influencing investor sentiment. The S&P 500 ended Friday’s session largely flat, while the Dow Jones dropped by 0.2%, and the tech-heavy Nasdaq experienced a slight uptick of 0.1%.

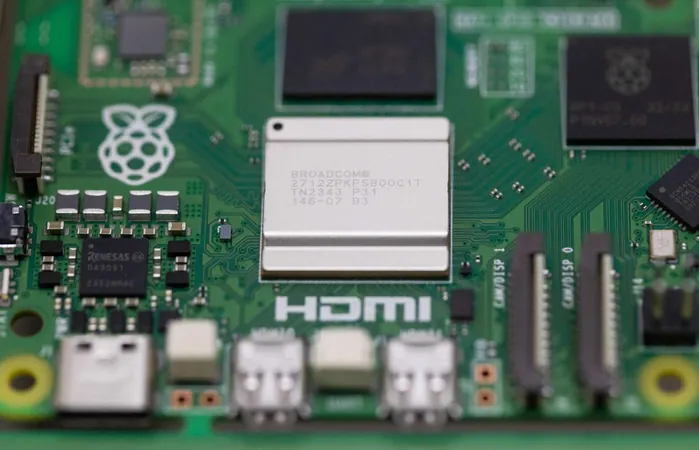

Major Highlights: Broadcom's Surge

A standout performer was Broadcom Inc. (AVGO), whose shares skyrocketed by an impressive 24.4%, catapulting the company’s market valuation past the $1 trillion mark for the first time. The semiconductor giant exceeded revenue and profit expectations in its fiscal fourth-quarter results, revealing a staggering growth in artificial intelligence sales that more than tripled year-over-year.

Market Reaction and Analyst Sentiment

Analysts have responded enthusiastically, with many raising their price targets due to Broadcom’s promising AI revenue trajectory. This remarkable leap made Broadcom the top performer in the S&P 500 for the day and highlighted the growing significance of AI in the tech sector.

Other Notable Movers

Meanwhile, other notable movers included Lamb Weston (LW), whose shares surged 6.8% amid reports about potential buyout discussions with Post Holdings (POST), a major player in the packaged goods sector. Walgreens Boots Alliance (WBA) also saw its stock rise by 6.8%.

Company-Specific Trends

Earlier in the week, shares had jumped on news that the pharmacy giant was contemplating a sale to private equity firm Sycamore Partners. After a brief period of profit-taking, the stock regained its momentum on Friday, reflecting strong investor interest.

Growth in the Tech Sector

In terms of growth, Arista Networks (ANET) experienced a 5.1% increase, hitting a new all-time high. Analysts at Citi have pointed to Arista as a likely beneficiary of the rising demand for AI technologies, notably in data center infrastructure.

Downside: Nucor's Decline

On the downside, Nucor (NUE) faced a nearly 4.7% decline in its share price after UBS downgraded the steelmaker from 'buy' to 'neutral.' The stock has been under pressure following a period of significant gains.

Looking Ahead

As the market continues to react to both economic indicators and company performances, investors will be keenly observing the Federal Reserve's forthcoming decisions and their potential effects on the stock landscape.

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)