Robinhood Unveils Revolutionary Banking and Wealth Management Services!

2025-03-27

Author: Kai

Introduction

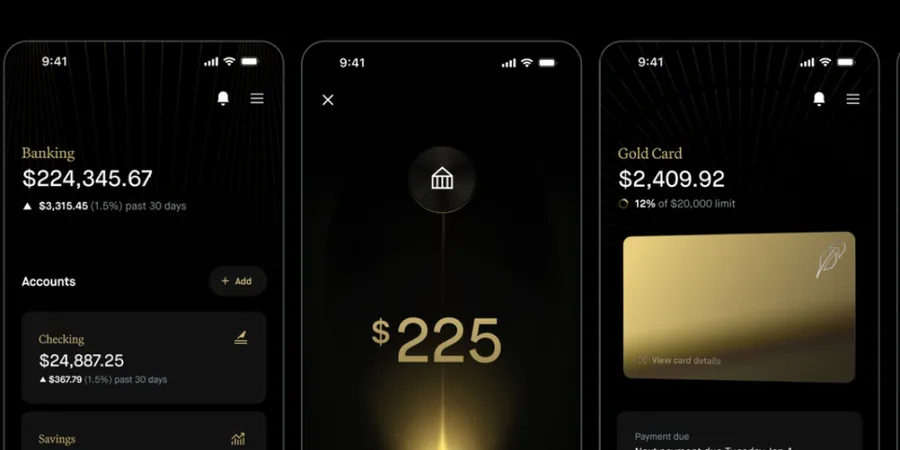

In a groundbreaking move that has the potential to reshape the financial landscape, Robinhood has officially launched its new banking and wealth management services. This innovative step is designed to empower users with holistic financial tools aimed at democratizing personal finance and investment opportunities.

Enhanced Offerings

The platform, which gained acclaim for its commission-free trading model, now seeks to enhance its offerings by providing users with a seamless banking experience. Customers will be able to manage their banking needs alongside their investments, all within one user-friendly app. This will include features such as high-yield savings accounts, budgeting tools, and diversified investment options, catering to both novice and seasoned investors alike.

Security and User Protection

Furthermore, Robinhood’s banking services are backed by a robust security framework designed to protect user data and finances. As the company continues to innovate, it’s clear that its goal is not just to attract new users but to create a comprehensive financial ecosystem where investment and banking go hand in hand.

Industry Context

This launch comes at a time when traditional banking institutions are facing increasing pressure to modernize and keep up with fintech disruptors. With its vast user base, Robinhood is poised to capitalize on this shift, offering consumers a refreshing alternative to conventional banking and wealth management.

Conclusion

Stay tuned as Robinhood seeks to redefine what it means to manage wealth in the digital age. Investors and consumers alike should keep an eye on this evolving story, as many wonder what additional services will follow in the near future!

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

Česko (CS)

Česko (CS)

대한민국 (KO)

대한민국 (KO)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)

الإمارات العربية المتحدة (AR)

الإمارات العربية المتحدة (AR)