Rethinking Rate Cuts: A Shift in Treasury Yields and Mortgage Rates Soar Above 7%

2024-12-22

Author: Ying

Rethinking Rate Cuts

In a surprising turn of events, the Treasury yield curve has completely reversed its previous inversion, as long-term yields climb while short-term yields remain stagnant. This shift comes on the heels of the Federal Reserve's recent monetary policy adjustments, raising concerns about future rate cuts.

Impact of Fed's Rate Cuts

On December 13, 2024, the Federal Reserve reduced its policy rates by 25 basis points, marking a total cut of 100 basis points since September. However, the Fed's latest forecast now anticipates only two rate cuts in 2025, a significant reduction from prior projections that expected multiple cuts. This adjustment in outlook, articulated by Fed Chair Jerome Powell during the press conference, has left many analysts questioning the likelihood of any rate cuts in 2025.

Market Reactions

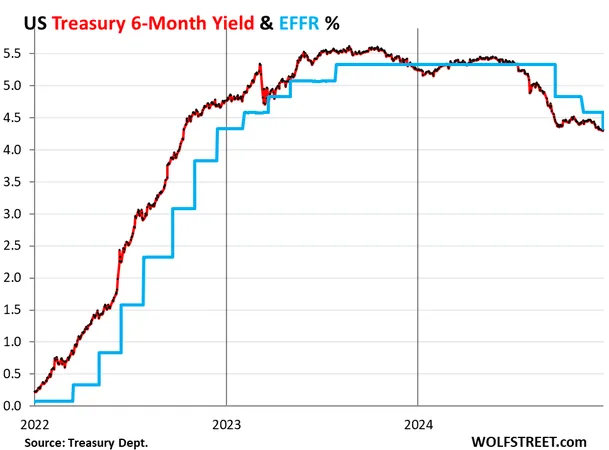

The immediate impact was felt in the stock market, with the S&P 500 index plummeting by 3%, reflecting investor uncertainty. Meanwhile, the Treasury market is echoing these sentiments, as short-term yields have remained unchanged this week. The yields for one to six-month Treasury securities settled around 4.30% to 4.33%, aligning closely with the Effective Federal Funds Rate (currently at 4.33%).

Yield Curve Normalization

Significantly, the 6-month Treasury yield has ceased to factor in any potential rate cuts within its time frame. This is a stark contrast to the earlier months when it reacted ahead of rate changes. The yield curve, which inverted back in July 2022, is now moving towards normalization, but it still retains a relatively flat profile with a 22-basis point spread between the 2-year and 10-year yields.

Long-Term Yields and Mortgage Rates

Long-term Treasury yields are experiencing upward momentum. For instance, the 10-year yield has increased by 12 basis points to reach 4.52%, while the 30-year yield rose by 11 basis points, landing at 4.72%. This rise may indicate investor confidence in longer-term economic growth prospects despite current market volatility.

Surge in Mortgage Rates

As a direct consequence of these changes, mortgage rates have surged back above 7%. Since the first rate cut was announced in September, the average 30-year fixed mortgage rate has skyrocketed from 6.11% to an alarming 7.04%, as reported by Mortgage News Daily. This rise far outpaces the increase in the 10-year Treasury yield, reflecting broader market conditions, including supply chain issues, inflation fears, and tighter lending standards.

Conclusion

Homebuyers might need to brace themselves for a new normal as mortgage rates approach levels seen before the 2008 financial crisis. As the market stabilizes, prospective homebuyers may need to navigate these higher costs, which could dampen demand in a traditionally robust housing market. The path forward is uncertain, and with the Fed's cautious stance on rate cuts, market participants will need to adapt to a potentially prolonged period of elevated interest rates. Will we see a return to lower mortgage rates anytime soon, or is this just the beginning of a new economic chapter? Only time will tell.

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

Česko (CS)

Česko (CS)

대한민국 (KO)

대한민국 (KO)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)

الإمارات العربية المتحدة (AR)

الإمارات العربية المتحدة (AR)