Nvidia's Rollercoaster Ride: What Investors Need to Know!

2025-01-08

Author: Ming

Nvidia's All-Time High Amidst Enthusiasm

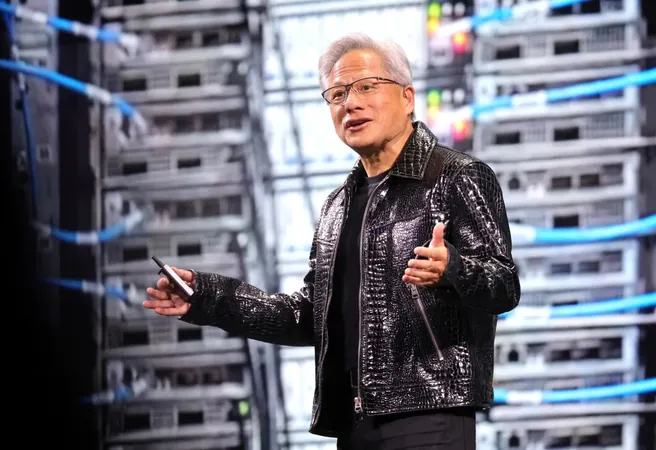

In a stunning showcase of volatility, Nvidia has once again captured the spotlight, closing at an all-time high on Monday, buoyed by investor enthusiasm ahead of CEO Jensen Huang’s highly anticipated keynote address at CES. As Huang addressed an enthusiastic crowd of over 6,000 in Las Vegas, he painted an exhilarating picture of an emerging 'era of physical AI,' igniting excitement around the new possibilities for artificial intelligence.

Jensen Huang's Keynote Highlights

During his presentation, Huang proclaimed, 'The ChatGPT moment for general robotics is just around the corner,' signaling that transformative advancements in AI are just beginning to take shape. He emphasized Nvidia's pivotal role in this evolution, especially through its partnerships with automotive giants like Toyota and Volvo, showcasing how their DRIVE Hyperion platform is set to power the next generation of autonomous vehicles. 'Building autonomous vehicles, like all robots, requires three computers: one for training, another for simulation, and one installed within the vehicle. Nvidia is at the helm of them all,' Huang stated, clearly positioning Nvidia at the forefront of this technological revolution.

Market Reaction and Sell-Offs

While investors initially basked in the optimism surrounding Nvidia's advancements, the enthusiasm quickly shifted to caution as markets opened on Tuesday. A significant 'sell the news' reaction led to a staggering $220 billion plunge in Nvidia's market capitalization, marking its worst single-day drop in four months. This pattern is not new for Nvidia; the tech giant has seen stock prices soar followed by dramatic sell-offs multiple times in recent history.

Historical Trends and Pullbacks

For instance, following Nvidia's impressive earnings report on November 20, the stock surged above $150, only to face a sharp 13% dip shortly afterward. A similar story unfolded on June 20, when shares reached $140, leading to a stunning 27% decline afterward. Historical trends suggest that Nvidia's record highs might simply set the stage for a subsequent pullback, as seen with its lackluster performance after the August 23 earnings announcement, which sent its shares to $50 but then caused frustration among investors trading sideways for months.

Looking Ahead: Buy the Dip or Caution?

Nevertheless, as the undisputed leader in this bull market, Nvidia's rollercoaster ride reflects larger trends within the U.S. stock market. Despite these setbacks, Nvidia's overarching impact remains profound, as it continues to drive innovation and excitement in the tech industry. Investors are left to navigate the volatile relationship between groundbreaking advancements and market reactions, as they ponder: could this be the best time to buy the dip, or is a cautionary approach warranted?

The Uncertain Future of Nvidia's Stock

As Nvidia continues to reshape the landscape of AI and autonomous technology, the stock's future remains a topic of fervent discussion among analysts and investors alike. Will it bounce back stronger than ever, or are more dips in store? Only time will tell, but one thing is for certain: Nvidia's journey is far from over!

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

Česko (CS)

Česko (CS)

대한민국 (KO)

대한민국 (KO)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)

الإمارات العربية المتحدة (AR)

الإمارات العربية المتحدة (AR)