Mortgage Rates Skyrocket as Treasury Yields Surge Post-Rate Cut – What It Means for Homebuyers

2025-09-22

Author: Ting

Market Shockwaves: Treasury Yields and Mortgage Rates Surge

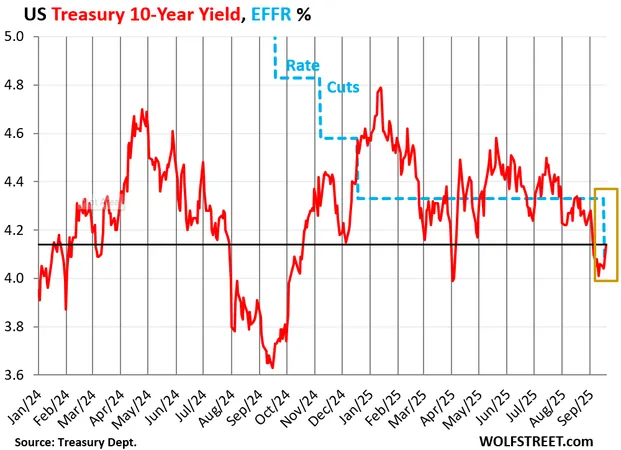

In a surprising turn of events, the bond market is reacting strongly to inflation expectations, sending long-term Treasury yields and mortgage rates soaring. Just last Friday, the 10-year Treasury yield climbed to 4.14%, rebounding from a brief dip below the critical 4% mark earlier this month.

The shock came after the Federal Reserve announced a 25-basis-point cut in the Effective Federal Funds Rate (EFFR), which now stands at 4.08%. This unusual scenario — where rate cuts lead to rising long-term yields — mirrors what happened last year when the Fed slashed rates, only to see bond traders panic amid spiking inflation.

A Battle of Expectations: The Diverging Yield Curves

The bond market is currently grappling with contrasting signals. While the 30-year Treasury yield ended the week at 4.75%, a stark rise from its pre-rate cut level, it reflects concerns over future inflation and the supply of new bonds rather than the Fed's policy shifts.

This divergence has created an intriguing dynamic, as shorter-term yields, like the six-month Treasury, react to expectations of the Fed's next moves. Market sentiments suggest potential further rate cuts, but long-term yields remain tethered to inflation fears.

Mortgage Rates Jump: What Homebuyers Need to Know

In a blow to prospective homebuyers, 30-year fixed mortgage rates have surged significantly post-rate cut, reaching 6.35% — an increase of 22 basis points since mid-September. This spike is nearly double the increase seen in 10-year Treasury yields, reigniting memories of last year's turbulent reactions to similar Fed decisions.

With home prices skyrocketing over 50% between 2020 and 2022 due to the Fed's ultra-low interest rates, these mortgage rates now pose a substantial hurdle for buyers. Historical context reminds us that even these rates are at the lower end of the spectrum; however, current inflated home values coupled with rising rates spell trouble for the housing market.

The Fed’s Tightrope: Managing Inflation and Economic Stability

The delicate balance of cutting rates during ongoing inflation is proving to be a challenging act for the Fed. While a stable inflation rate around 2% could ease tensions, ongoing spikes in service and goods prices could further unsettle the bond market. As mortgage rates climb, potential buyers may find themselves rethinking their plans amidst these rapidly shifting market conditions.

As we move forward, keep an eye on inflation data; it could dictate the trajectory of mortgage rates and the broader economic landscape. The bond market is on high alert, and how the Fed navigates this storm will be crucial for shaping the future of borrowing costs.

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

Česko (CS)

Česko (CS)

대한민국 (KO)

대한민국 (KO)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)

الإمارات العربية المتحدة (AR)

الإمارات العربية المتحدة (AR)