Massive Legal Showdown: FTX Sues Binance for $1.76 Billion in Crypto Clash!

2024-11-11

Author: Ling

Introduction

In a stunning turn of events in the cryptocurrency world, the bankrupt exchange FTX has launched a lawsuit against its former competitor Binance, seeking a whopping $1.76 billion. This legal battle highlights the ongoing unraveling of one of the industry's largest scandals, involving key players who were once at the top of the crypto hierarchy.

The Lawsuit Details

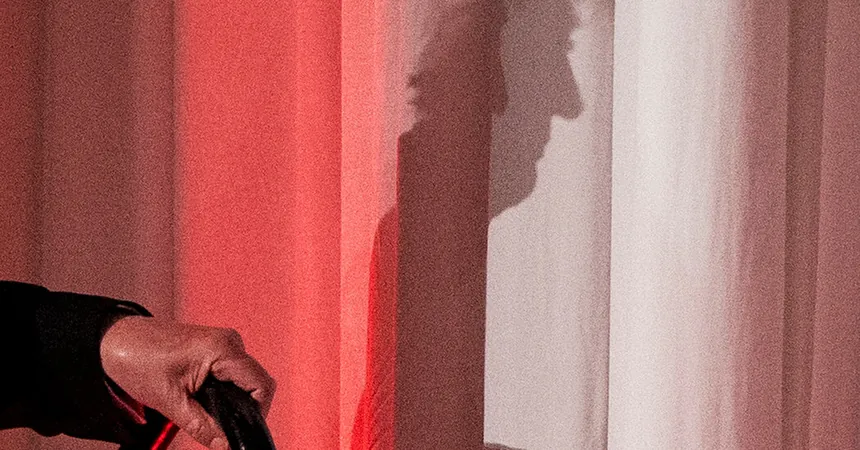

The complaint filed in US Bankruptcy Court in Delaware accuses Binance, alongside its co-founder and former CEO Changpeng Zhao, of participating in a fraudulent scheme that diverted substantial assets from FTX to Binance. The lawsuit alleges that the massive fund transfer occurred "at the expense of FTX creditors" and seeks both compensatory and punitive damages, which are yet to be determined at trial.

Background of the Conflict

The saga began when FTX's founder, Sam Bankman-Fried, sold a 20% stake in the exchange to Binance in November 2019. However, by July 2021, amid internal strife and personal grievances, Zhao decided to exit this investment, leading to FTX repurchasing the shares at a staggering valuation using a mix of tokens—including FTT, BNB, and BUSD—that had a reported market value of at least $1.76 billion. Yet, by this time, both FTX and its trading partner Alameda Research were already insolvent, raising questions about the legitimacy of this transaction.

Allegations Against Zhao

The lawsuit suggests that this transfer not only constitutes a fraudulent transfer under bankruptcy law but was also part of Bankman-Fried's broader scheme to cloak FTX's financial instability from the market. Testimonies indicate that Alameda funded the repurchase using depositor capital, further exacerbating the situation and setting the stage for FTX's demise.

Impact of Zhao's Actions

Additionally, the complaint paints a picture of Zhao as not only an ex-investor but as someone who played a role in damaging FTX's reputation and operations. Allegations include that he orchestrated a series of misleading tweets aimed at destabilizing FTX, leading to a massive withdrawal rush that precipitated the company’s collapse. The lawsuit details how these tweets were crafted at a moment when Zhao was already aware of FTX's struggling financial state, casting doubt on his claims of innocent intent.

FTX's Broader Legal Strategy

But this lawsuit is just part of a larger strategy by FTX's bankruptcy estate, which has filed multiple suits against various entities—including notable names such as Anthony Scaramucci and Crypto.com—as it seeks to recover funds for its creditors. With 23 lawsuits filed last Friday alone, the unraveling drama of FTX continues to capture headlines and shake the foundations of the cryptocurrency space.

Binance's Response

In light of the claims, Binance has vehemently denied wrongdoing, calling the lawsuit "meritless" and pledging to defend its position vigorously. As the case moves forward, many in the crypto community are left wondering about the ripple effects this legal battle could have on investor confidence and the future of cryptocurrency exchanges.

Conclusion

The courtroom drama is just beginning, and this high-stakes lawsuit could change the landscape of the crypto industry as we know it. Stay tuned as more developments unfold in this epic saga of digital finance gone awry!

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)