Markets Breathe a Sigh of Relief Amid Intensifying Trade Tensions

2025-04-08

Author: Ying

Market Stabilization Amid Chaos

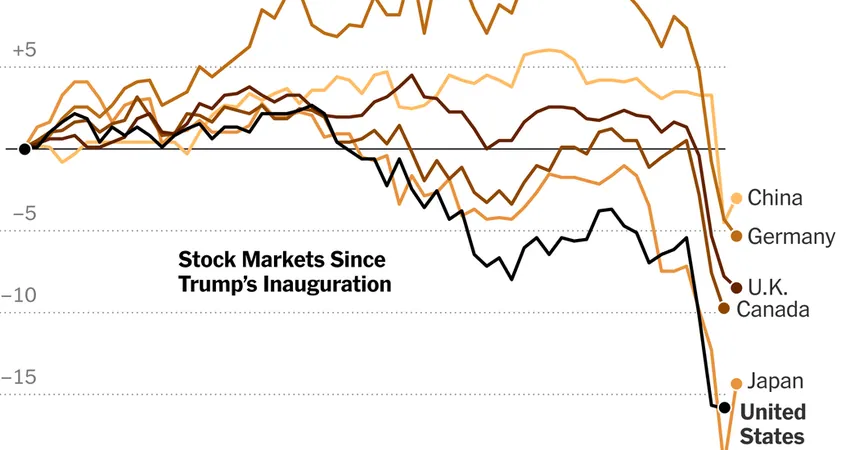

In a surprising turn of events, global stock markets managed to stabilize on Tuesday after enduring three days of extreme chaos reminiscent of the early Covid-19 pandemic turmoil. This resurgence occurred despite continued escalations in trade tensions spurred by President Trump’s swiftly imposed tariffs.

China's Measures to Support Stocks

Prior to market openings in China, the government implemented a series of strategic measures aimed at stabilizing the stock market. As a result, stock prices in Hong Kong rebounded significantly, recovering nearly 1.5% from the previous day’s staggering drop of 13.2%. Meanwhile, Japan’s stock market experienced a robust gain of 6%, with traders buoyed by comments from U.S. Treasury Secretary Scott Bessent, who hinted at upcoming discussions with the Japanese government on tariff issues.

European Markets Respond Positively

Europe also witnessed a positive response, with the Stoxx Europe 600 index rising about 1% in early trading. Most major markets in the region appeared to be on an upward trajectory, although the pan-European benchmark still lingers approximately 15% below its March peak.

U.S. Market Uncertainty

The market turbulence stemmed from President Trump’s recent announcement of broad new tariffs, implementing a baseline tax of 10% on American imports and significantly higher rates on numerous countries including a staggering 34% tariff on goods from China. In response, China has announced its own retaliatory measures, raising tariffs on American imports, further intensifying the trade conflict.

Wall Street Executive Concerns

Concerns regarding the long-term impacts of escalating trade tensions on the global economy are rising among Wall Street executives. Jamie Dimon, CEO of JPMorgan Chase, emphasized in his annual shareholder letter that swift resolution of these issues is crucial, as the negative ramifications can compound over time and may complicate future recovery efforts.

Sector Impacts and Oil Prices

The anticipated economic slowdown has begun to seep into various sectors, most notably reflected in the plummeting price of oil. Brent crude is currently trading around $64 a barrel, a sharp decline from over $80 just three months ago, underscoring the broader economic apprehensions linked to trade friction.

S&P 500's Notable Decline

Notably, the S&P 500’s 10.5% drop last Thursday and Friday marked its worst two-day decline since the onset of the pandemic.

President Trump's Ultimatum to China

As the clock ticks down to Wednesday’s implementation of higher tariffs, President Trump remains steadfast in his aggressive trade approach, issuing an ultimatum to China: remove its retaliatory tariffs or face an additional 50% tariff starting Wednesday. However, China has shown no signs of acquiescence.

China's National Team Intervention

In a concerted effort to stabilize their markets, various state departments and government-owned firms declared their commitment to supporting the smooth operation of capital markets. The People's Bank of China announced its backing for Central Huijin Investment, which is reportedly increasing its holdings in stock funds.

Share Buyback Programs

Additionally, several companies, particularly state-owned enterprises, have initiated share buyback programs—typically perceived as bullish moves intended to boost stock prices.

Expert Cautions on Trade Tensions

This intervention by what is known as China’s "national team" echoes strategies employed during a 2015 market crisis, where government actions aimed to bolster investor confidence after a series of missteps. This time, however, it appears to align with President Xi Jinping's larger vision of showcasing the Chinese government as a stabilizing force amid market turmoil triggered by Trump's policies.

Looking Ahead

The effectiveness of these measures remains to be seen. While the attempt to stabilize the market could soothe investor nerves, experts like Zhiwu Chen, a finance professor at The University of Hong Kong, caution that the trade tensions could disrupt the broader economic landscape, emphasizing that the implications go beyond mere market psychology.

Conclusion

As the global economy braces for the potential ramifications of these unresolved trade battles, all eyes will remain on the unfolding developments in both the U.S. and China, with investors hoping for a return to market stability. Stay tuned as we continue to track this escalating saga that could shape the global economic landscape for years to come.

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

Česko (CS)

Česko (CS)

대한민국 (KO)

대한민국 (KO)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)

الإمارات العربية المتحدة (AR)

الإمارات العربية المتحدة (AR)