Major Acquisition of United States Steel Corporation Blocked by Biden Administration

2025-04-07

Author: Jessica Wong

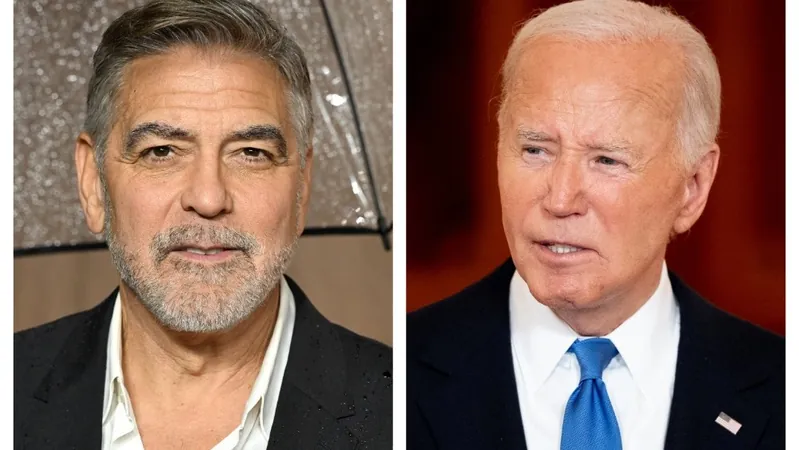

In a striking move that has sent ripples through the business and political sectors, President Joe Biden issued an order on January 3, 2025, to prohibit the acquisition of United States Steel Corporation (commonly known as U.S. Steel) by a consortium of Japanese companies led by Nippon Steel Corporation. The decision has raised eyebrows and stirred speculation about the intent behind this unexpected intervention.

The President's order not only halts the merger but also clearly signals the administration's commitment to safeguarding national security interests. Biden emphasized his right to take further measures concerning both the Purchasers and U.S. Steel if deemed necessary to protect the economic integrity of the United States.

To further investigate this acquisition, Biden has directed the Committee on Foreign Investment in the United States (CFIUS) to conduct a thorough review. This analysis will focus on potential national security risks that could be posed by the acquisition. The review will be conducted confidentially and in accordance with the procedures laid out under the Defense Production Act of 1950, particularly section 721, which governs foreign investments impacting national security.

The CFIUS is expected to complete its assessment within 45 days, providing recommendations to the President on whether any proposed measures by the parties involved would adequately reduce any identified security risks. Each agency member's viewpoint will be included in this recommendation, ensuring a comprehensive evaluation of the implications of the deal.

The national security aspect takes center stage as the administration takes a strong stand against foreign ownership of American assets, particularly in crucial sectors like steel production, which is integral to national defense and infrastructure. The U.S. has recently become increasingly wary of foreign acquisitions, particularly by companies from countries with strained relations with the United States.

This acquisition bid from Nippon Steel follows significant investments by foreign entities in U.S. infrastructure and manufacturing, sparking a wider debate on the balance between foreign investment and domestic security. The steel industry's critical importance in national defense projects, such as construction materials for military equipment and infrastructure, cannot be overlooked.

As the situation unfolds, all eyes will be on CFIUS and its forthcoming recommendations. Will the Biden administration's move to block this acquisition mark the beginning of a broader reevaluation of foreign investments in key industries? Only time will tell, but one thing is clear: the intersection of economics and national security is more crucial now than ever.

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

Česko (CS)

Česko (CS)

대한민국 (KO)

대한민국 (KO)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)

الإمارات العربية المتحدة (AR)

الإمارات العربية المتحدة (AR)