Is Hong Kong's New Russian Supermarket the Future of Sino-Russian Trade, or Just Another Gold Mine of Deceit?

2025-03-16

Author: Jia

Introduction

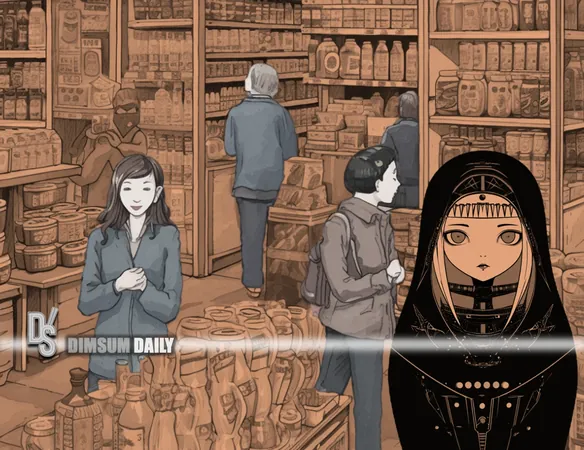

The grand opening of the Siberia Taiga supermarket in Hong Kong’s bustling Mong Kok district isn’t merely about introducing new Russian goods to the shelves—it's a vivid illustration of how international relations interlink with consumer behavior in today's complex geopolitical climate. As China and Russia deepen their ties in opposition to Western dominance, this 1,300-square-foot haven for Russian products on Sai Yeung Choi Street South serves as both an opportunity and a test for the authenticity of Sino-Russian commerce.

Shifting Consumer Sentiments

In recent years, Chinese consumer sentiment has noticeably shifted away from Western brands, paving the way for Russian products. In fact, industry statistics reveal that over 2,500 Russian-themed businesses have emerged in China since 2022, with bilateral trade booming to record levels. However, will Hong Kong's discerning consumers embrace them as eagerly as their counterparts on the mainland?

Skepticism and Authenticity Challenges

While trendy items—like liquor bottled in the shape of an AK-47 selling for HK$1,599 and premium caviar priced at HK$659 for just 50 grams—attract attention, they face a skeptical audience. This skepticism is heightened by investigative reports from Russian bloggers like “Xiao An in China,” uncovering a shocking truth: many so-called Russian products available in mainland stores were actually manufactured in northeastern China, often with laughably inaccurate translations on their labels. In some egregious cases, prices have been marked up by as much as 3,400%.

Authenticity and Differentiation

This troubling trend raises critical questions about the authenticity of products marketed as Russian. The appetite for genuine goods is strong, but trends show that many consumers are willing to overlook certain discrepancies for the sake of political allegiance. In contrast, Hong Kong's international consumer base—armed with a keener awareness and appreciation for quality—might not be as forgiving.

To differentiate itself, Siberia Taiga's management asserts that all its products are sourced directly from Russia and come with official certification. Yet, the memory of similar claims by mainland operators, which have crumbled under investigation, looms large. Can this store truly promise authenticity when verification methods are less than robust?

Economic Stakes and Consumer Dynamics

The stakes are high, as China becomes a vital economic lifeline for Russia amidst mounting Western sanctions. However, while the mainland might embrace Russian goods as political statements, Hong Kong’s cosmopolitan vibe introduces an intriguing layer of complexity. Here, consumers are not solely driven by ideology but also by a refined taste for authenticity and genuine quality.

Siberia Taiga has positioned itself as a premium option, suggesting a belief that Hong Kong residents will pay a premium for true Russian authenticity. Still, maintaining this premium status while ensuring genuine sourcing may not be straightforward.

Market Fraud and Regulatory Challenges

State measures in mainland China have already highlighted how rampant fraud can disrupt the market. In a recent crackdown in Shanghai, 47 Russian-themed stores were inspected, revealing numerous violations related to misleading advertising and false claims of origins. Seven of these establishments were caught falsely presenting themselves as “state pavilions.”

Opportunities and Future of Sino-Russian Commerce

Meanwhile, the Russian Export Center's ambitious plan to create 300 officially recognized stores across China sends a strong message from Moscow—it recognizes both challenges and opportunities in this burgeoning market. Their attempt to introduce a dove-shaped “Made in Russia” label aims to tackle authenticity issues, though its success hinges on proper execution and stringent verification.

For consumers in Hong Kong, the allure of Russian products runs deeper than their novelty; the city's rich culinary landscape and appreciation for global flavors may offer a more stable market for authentic imports compared to the politically driven demand observed on the mainland. However, initial foot traffic at the Siberia Taiga store has been lackluster, due in part to adverse weather, which begs the question: will this curiosity translate into sustained interest?

Diplomatic Dimensions and the Future of Siberia Taiga

The attendance of Russian Consulate representatives during the store's launch illustrates the diplomatic dimensions of this enterprise. As the strategic partnership between China and Russia strengthens, ventures like Siberia Taiga serve both economic and political purposes.

Looking ahead, the supermarket’s chances for success may hinge on its ability to stand apart from disreputable mainland operations. Commitment to transparent sourcing, authenticity, and fair pricing will be vital in building the trust of a sophisticated consumer base.

Conclusion

If Siberia Taiga can navigate Hong Kong’s demanding environment successfully, it could pave the way for a genuine model of Russian retail in China, breaking free from the quagmire of counterfeits and misrepresentation. However, a pressing question remains: can this retail model realistically subsist on truly authentic products, or does it inherently rely on the flexibility of local production and creative marketing strategies? The experiences garnered at Siberia Taiga may hold invaluable insights for the future of Sino-Russian commerce.

Ultimately, the fate of this venture may hinge less on prevailing geopolitical tides and more on core retail principles: authenticity, value, and the drive for customer satisfaction. In this regard, Hong Kong's sophisticated market may play a pivotal role in distinguishing genuine Russian business from mere marketing hype.

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

Česko (CS)

Česko (CS)

대한민국 (KO)

대한민국 (KO)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)