Global Markets Brace for Fed Easing: A Financial Tectonic Shift on the Horizon!

2024-09-15

Global Markets Brace for Fed Easing: A Financial Tectonic Shift on the Horizon!

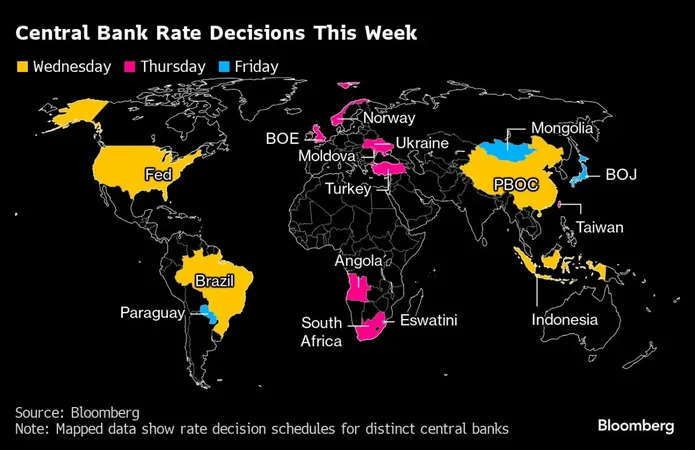

The world economy is poised for a dramatic shift this week as the Federal Reserve prepares to kick off a new easing cycle, coinciding with critical policy decisions from central banks across Europe and Asia amid fragile market conditions.

Starting with the Fed's expected decision to cut interest rates on Wednesday, a tumultuous 36-hour period will ensue, culminating in the Bank of Japan's (BOJ) crucial meeting on Friday—its first since raising borrowing costs, a move that contributed to a recent wave of global market sell-offs.

In this whirlwind of monetary policy updates, other key central banks will also be evaluating their strategies. Brazil is set to tighten its policy for the first time in over three years, while the Bank of England faces tough choices regarding its balance sheet unwind. South African authorities are anticipated to slash borrowing costs for the first time since 2020, offering a glimmer of relief in what has been a turbulent economic period.

The Fed Takes Center Stage: Expect the Unexpected!

The Fed's decision is crucial, with traders divided over whether a 25 basis-point cut will suffice or whether a steeper 50 basis-point reduction is required to combat signs of a cooling economy. As whispers circulate that Fed Chair Jerome Powell might favor the larger cut, market observers are left waiting for clarity on the committee’s collective stance. This uncertain atmosphere will likely keep investors on edge until the BOJ releases its decision, which is expected to shed light on its future moves regarding rate hikes stemming from deflationary pressures in Japan.

Meanwhile, the Chinese economy is grabbing attention as officials are expected to announce monetary policy changes soon, following alarming deflation indicators.

US and Canadian Forecasts: Consumer Activity Under Scrutiny

As Fed officials meet for a two-day deliberation, they will be equipped with fresh data on consumer demand. Although retail spending showed resilience, particularly outside the automobile sector, factory output appears to be lagging. With ongoing high borrowing costs and the approaching November elections, cautious capital investment further complicates the economic picture.

In Canada, inflationary trends are projected to decelerate, keeping the Bank of Canada on its easing path.

Asian Markets Prepare for a Storm: BOJ's Decision is Crucial

Expectations are high as the BOJ prepares to announce its policy on Friday, with a consensus that rates will remain unchanged. However, how BOJ Governor Kazuo Ueda communicates the future trajectory of rates could drastically impact the yen, particularly following surprising currency movements this month.

In China and other Asian economies, monetary policy is similarly expected to remain stable, while Japan’s consumer inflation data hints at future rate hike considerations.

Europe, Middle East, and Africa Face Potential Follow-Through from Fed Easing

Central banks in Europe, especially in the Gulf States, may find themselves inclined to reduce rates in response to the Fed's policy shifts, as they grapple with their dependency on dollar-denominated energy exports. Additionally, the Bank of England's decision will be closely watched as it navigates the complexities of unwinding its bond portfolio amidst economic pressures.

Latin America: Brazil Takes a Stand Amid Economic Overheating

In Brazil, heightened inflation and a booming economy have led analysts to expect tighter monetary policy for the first time in years. Conversely, the economic turmoil in Argentina reflects the struggles of comprehensive fiscal reforms under President Javier Milei, with early budget data indicating a refusal to concede to austerity while output continues to contract.

As global investors anxiously anticipate these pivotal monetary decisions, one thing is clear: the environment is rife with volatility, and markets are bracing for a significant shift in the coming days. Keep your eyes peeled as these critical updates unfold—your next investment move could depend on them!

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)