From Soviet Refugee to Hedge Fund Tycoon: The Ingenious Journey of Igor Tulchinsky

2025-05-16

Author: Wai

A Calculated Fortune: How Igor Tulchinsky Outsmarted Wall Street

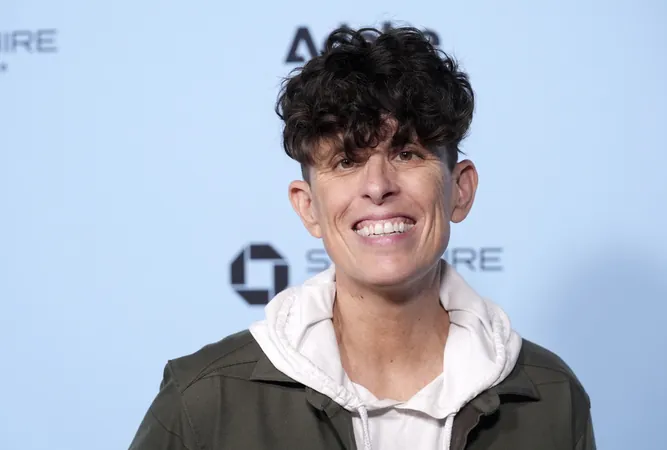

On a brisk March morning in Midtown Manhattan, Igor Tulchinsky, the mastermind behind the hedge fund WorldQuant, shares his latest groundbreaking vision: integrating large language models (LLMs) into his trading strategies. Clad in all black, with his piercing blue eyes sparkling with enthusiasm, he passionately declares, "It's like a free lunch." Tulchinsky is not just any trader; he’s a self-made billionaire whose fortune stemmed from an unwavering fixation on data.

Having immigrated to the U.S. from Belarus as a child, Tulchinsky has transformed quantitative investing into a lucrative empire. At 58, he oversees WorldQuant, which manages an astounding $10 billion for the heavyweight hedge fund Millennium Management and another $13 billion for WorldQuant Millennium Advisors, which he co-founded with billionaire Izzy Englander. His personal net worth? A jaw-dropping $1.7 billion.

The Art of Quantitative Trading: Ripping Through Market Inefficiencies

Quants like Tulchinsky utilize ingenious computer codes to execute stock trades based on intricate price signals. Specializing in statistical arbitrage—essentially capitalizing on price discrepancies—his algorithms, or 'alphas,' navigate everything from long positions to complex hedge fund strategies that remain closely guarded secrets. "We trade the ripples, not the waves," Tulchinsky asserts, a testament to the massive volume of trades his funds execute daily, often reaching into the hundreds of thousands.

Harnessing AI: The Future of Trading Strategies

Now, Tulchinsky is eager to revolutionize his strategy further by combining traditional alpha development with the power of large language models, like those akin to OpenAI’s ChatGPT. He envisions a world where AI not only helps discover new algorithms but can also enhance research capabilities, making predictions based on giant datasets. As he puts it, “The possibilities are endless.”

The financial world has long employed AI tools, but leveraging LLMs for trading strategies is still in its infancy. A report from the U.S. Senate highlighted this untapped potential, indicating a shift could soon be on the horizon. Tulchinsky’s firm, boasting a talent pool of over 150 PhDs, is uniquely positioned to lead this transformation.

A Journey of Resilience: From Minsk to Manhattan

Tulchinsky's fascination with data and technology can be traced back to a tumultuous childhood in communist Belarus. After his family fled oppressive regimes, they embarked on a three-month odyssey through Italy before eventually finding asylum in the United States. Shaped by a life of constant change, he grew up driven to embrace innovation.

A brilliant student, he honed his skills in programming and computer science, later earning prestigious degrees from the University of Texas and Wharton. His career began in research at AT&T Bell Laboratories before moving to significant roles in finance, including a pivotal stint at Timber Hill.

Leading the Charge in Global Quantitative Talent

In 2007, Tulchinsky's vision culminated with the launch of WorldQuant, which faced initial turbulence but quickly recovered. His strategic foresight allowed him to pull assets from the market just before a major downturn, a testament to his formidable risk management strategy. Now, his firm employs 1,000 people across 27 cities worldwide, providing opportunities for emerging talent to contribute to its success.

Philanthropy and Future Endeavors

Tulchinsky doesn’t just focus on his business; he’s equally devoted to philanthropy. His $65 million investment into WorldQuant University provides worldwide access to tuition-free education in financial engineering. He's also an active investor in innovative startups and has penned three books on investing.

As his time with Forbes concludes, Tulchinsky darts off for a meeting, embodying his firm’s motto, “Change Is Progress.” Reflecting on his origins, he muses about how nothing has changed back in Belarus, contrasting it with the dynamic life he has made for himself. This is just the beginning for Tulchinsky as he leverages AI to redefine the future of finance.

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

Česko (CS)

Česko (CS)

대한민국 (KO)

대한민국 (KO)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)

الإمارات العربية المتحدة (AR)

الإمارات العربية المتحدة (AR)