Economic Fear Drives Down Stocks Linked to American Spending Habits

2025-03-14

Author: Ling

Economic Downturn and its Impact on Stock Markets

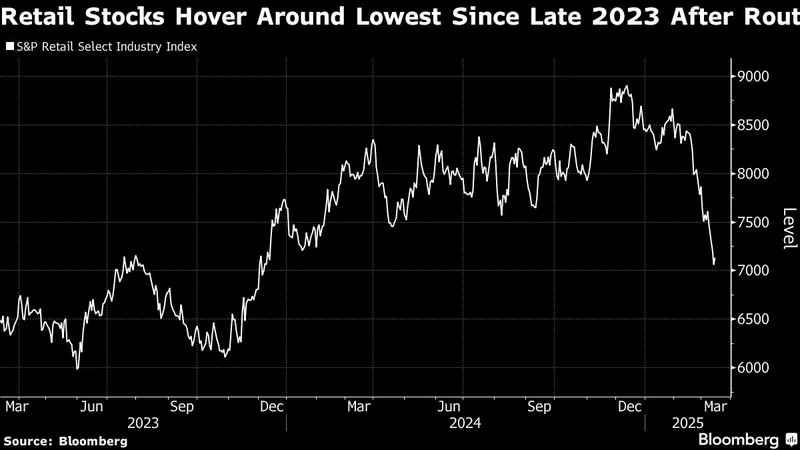

In a startling turn of events, the financial market is experiencing a significant downturn as fears surrounding the economy loom large, negatively impacting stocks that are closely tied to American consumer spending. Investors are grappling with growing concerns about inflation, potential recession, and shifting consumer behaviors, all of which contribute to the volatile landscape of retail and consumer goods.

Inflation and Consumer Behavior

Recent reports suggest that inflation rates are not subsiding as quickly as previously anticipated, causing a ripple effect across various sectors. Companies that rely heavily on consumer purchases, from retail giants to small businesses, are feeling the heat. Analysts warn that if consumer confidence continues to falter due to rising costs of living and uncertainty in the job market, the stocks of these businesses could continue to plummet.

Sector-Specific Declines

Notably, stocks in the retail and hospitality sectors have seen some of the most dramatic declines. Major brands that once thrived during the pandemic, offering online shopping and delivery options, are now struggling as consumers pull back on discretionary spending in response to tightening budgets. Retailers are being forced to reevaluate their strategies and adapt to changing patterns, such as embracing more budget-friendly options and enhancing their online presence to capture reluctant shoppers.

Investor Vigilance

Forecasters are urging investors to remain vigilant. The current economic climate is fraught with challenges as various factors including interest rate hikes and supply chain issues compound the problem. As companies grapple with these realities, many might resort to cost-cutting measures, further impacting their stock performance and potentially leading to layoffs.

Shifting Consumer Priorities

Market analysts suggest that consumers are shifting their priorities, focusing on essential spending rather than luxury items. This trend could spell trouble for many industries, as brands that once thrived on indulgent consumerism may need to pivot their offerings to cater to a more value-oriented shopper.

Conclusion and Outlook

As we navigate this uncertain economic terrain, experts advise closely monitoring market signals and consumer trends. Staying informed on how these developments affect stock prices and market sentiment will be crucial for investors looking to safeguard their portfolios.

In conclusion, while the fear of economic instability has cast a shadow over stocks tied to American spending, there remains hope for recovery. Companies that can adapt quickly and effectively to changing consumer dynamics may emerge stronger in the long run. As the saying goes, "What goes down must come up," and savvy investors know that with challenges come opportunities. Will you be ready to seize them?

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

Česko (CS)

Česko (CS)

대한민국 (KO)

대한민국 (KO)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)

الإمارات العربية المتحدة (AR)

الإمارات العربية المتحدة (AR)