Dow Takes a Nosedive: Over 1,100 Points Lost in Historic Slide!

2024-12-18

Author: Ling

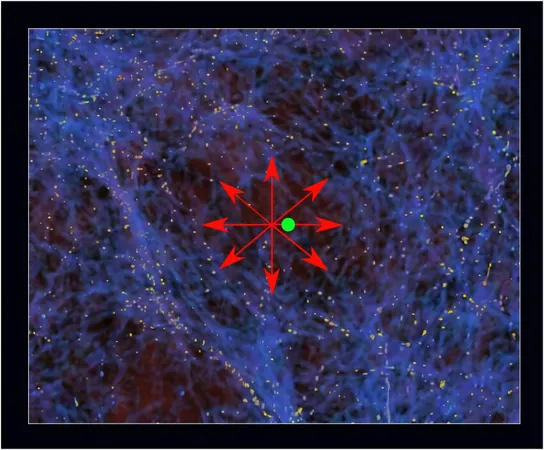

In a shocking turn of events, the Dow Jones Industrial Average experienced a staggering drop of over 1,123 points, or 2.6%, on Wednesday, marking its most extended losing streak since Gerald Ford's presidency in the mid-1970s. The blue-chip index has now seen 10 consecutive days of losses, reminiscent of a similar stretch that occurred from September 20 to October 4 in 1974.

The plunge comes on the heels of a disheartening outlook from the Federal Reserve, which unveiled a revised policy statement forecasting only two interest rate cuts in 2025—a significant reduction from the previously anticipated four. With inflation expectations now indicating a longer-than-expected battle to stay within target ranges, investors reacted swiftly, leading to a sell-off in the stock market that sent major indices spiraling downward.

The S&P 500 and Nasdaq Composite echoed the Dow's decline, recording drops of 3% and 3.6% respectively, despite remaining near all-time highs prior to Wednesday's downturn. Interestingly, this sell-off follows expectations of a rate cut that were realized—albeit the news of fewer anticipated cuts sent shockwaves through the market.

Market sentiment has drastically shifted post-Fed announcement, with traders recalibrating their expectations. Just a day earlier, there was a 98% likelihood priced into the market that the Fed would lower rates during its January meeting; however, following Fed Chair Jerome Powell’s press conference, that possibility plunged to just 6%.

"The market was underwhelmed by the expected future path of interest rates," noted Chris Zaccarelli, Chief Investment Officer at Northlight Asset Management.

Significantly impacting the Dow's performance, UnitedHealth Group has seen a 15% decline this month, heavily dragging down the index after the tragic shooting of its CEO, Brian Thompson. Despite the turmoil, UnitedHealth managed to close approximately 3.3% higher on Wednesday, showing some signs of recovery amidst the chaos.

Additionally, Nvidia's recent decline has also contributed to the Dow's struggles. While the chipmaker has boasted a remarkable 180% increase in its stock price year-to-date, it has seen about a 5% drop in the last month, further pressuring the Dow Jones.

However, it's worth noting that despite the current losing streak, the Dow is still ahead by 14% this year, an increase of over 5,000 points in 2024. This shows the resilience of the market even amidst a rough patch, with investors previously optimistic following recent election results that kept recounts and legal disputes at bay. The excitement surrounding promises from the new administration to cut taxes and reduce regulations also fueled earlier market enthusiasm.

As the situation develops, analysts and investors are now closely monitoring the Fed's future moves, hoping for stability in a market that has already shown its volatility. What will the next days bring—further drops or a rebound from this historic plunge? Stay tuned for updates on this unfolding financial saga!

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

Česko (CS)

Česko (CS)

대한민국 (KO)

대한민국 (KO)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)

الإمارات العربية المتحدة (AR)

الإمارات العربية المتحدة (AR)