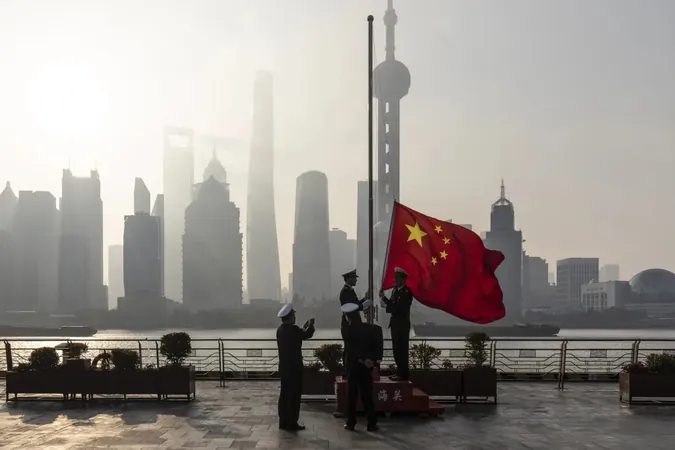

China Launches Significant Stimulus Package to Boost Economy Amid Growth Concerns

2024-09-24

China Launches Significant Stimulus Package to Boost Economy Amid Growth Concerns

In a bold response to sinking economic growth and dwindling investor confidence, China's central bank has unveiled a significant monetary stimulus package designed to revive the country’s economy and bolster the flagging market.

During a rare press briefing in Beijing, People’s Bank of China (PBOC) governor Pan Gongsheng announced critical monetary policy changes, including a cut to the key short-term interest rate and a reduction in the reserve requirement ratio (RRR) for banks. This RRR cut brings the required reserves to the lowest level since at least 2018, marking the first time both measures have been revealed simultaneously since 2015.

Accompanying these measures is a comprehensive plan aimed at supporting the beleaguered property sector. The PBOC will lower borrowing costs on as much as $5.3 trillion in mortgages, alongside easing regulations on second-home purchases. Additionally, the central bank pledged to inject approximately 800 billion yuan (around $113 billion) into the equity market to provide much-needed liquidity, with discussions underway about potentially establishing a market stabilization fund.

These moves come in light of economic data revealing that China is on the brink of failing to meet its annual growth target of approximately 5%. The aggressive policy measures are an attempt to rejuvenate investor sentiment and restore confidence in the stock market, where the benchmark CSI 300 Index observed a substantial 4.3% increase following the announcements, although it still remains over 40% down from its recent peak in 2021.

However, analysts caution that while these measures are a step in the right direction, they may not be enough to counter the longer-term challenges facing the economy, particularly pervasive deflation and an ongoing real estate crisis. They emphasize the need for additional strategies aimed directly at stimulating consumer demand.

“It’s unclear what singular solution can address all issues,” remarks Ken Wong, an Asian equity portfolio expert at Eastspring Investments. “Although the monetary easing is a positive move, more comprehensive actions are required to solidify growth targets for the fourth quarter.”

Furthermore, the context for these drastic measures is critical; China recently experienced its slowest growth rate in five quarters, raising alarms within the government. Policymakers are aware that without decisive action to stimulate consumer spending—hampered by fears of layoffs and declining corporate profits—the economy may stagnate further, with housing prices reaching their most significant decline since 2014.

The widespread impact of the Federal Reserve’s anticipatory actions across Asia has provided an opening for central banks in the region to consider more aggressive policy adjustments. However, monetary easing alone may not suffice if consumer confidence doesn’t return, which remains a major hurdle for the Chinese economy.

The recent stimulus package is indeed a pivotal moment for China's monetary policy landscape. By coordinating extensive measures in a single announcement, officials signal urgency in addressing deflationary risks and achieving targeted growth. Some analysts predict a modest uplift in economic performance in the coming years, but question whether the current approach is enough to incite a significant turnaround.

What remains to be seen is whether these initial steps will catalyze further substantial measures or if they are the government's last resort before transitioning to a more aggressive fiscal strategy. The world eyes China, wondering if these ambitious plans will be sufficient to arrest the economic slide or if further interventions are imminent.

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)