Brace for Impact: Billionaire Investor Sounds Alarm on US Economic Future

2025-04-14

Author: Kai

In a stark warning, billionaire investor Ray Dalio says the United States might be on the verge of something far more catastrophic than just a recession. As the founder of Bridgewater Associates, Dalio has a track record of predicting economic downturns, including the 2008 financial crisis.

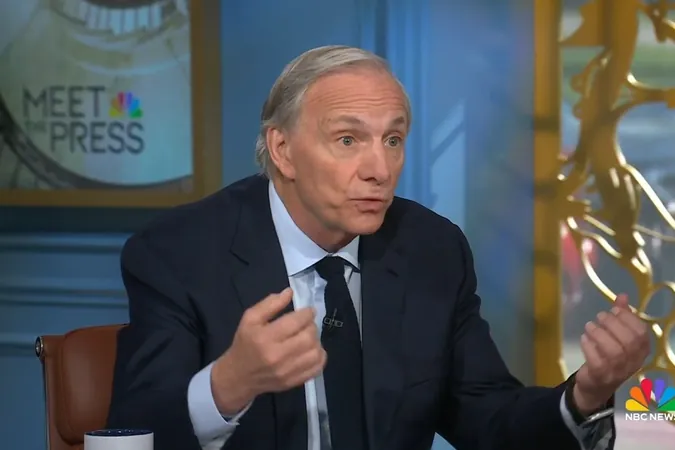

During a recent appearance on NBC's Meet the Press, Dalio expressed deep concern over the market instability fueled by Donald Trump’s controversial tariff announcements. He argued that these actions were disrupting not only U.S. businesses but also the broader global trading landscape.

Trump's Tariffs: A Recipe for Economic Turmoil?

Dalio emphasized that how the White House navigates these turbulent waters will be crucial in determining the fate of the economy. Drawing parallels to the tumultuous 1930s, he noted that America is undergoing significant transformations both domestically and globally. "We are facing profound changes in our order," he stated.

With U.S. federal debt soaring past $36 trillion, Dalio labeled it a 'ticking time bomb' that threatens future spending and borrowing capabilities. He contended that the current monetary system is breaking down, urging Congress to commit to a '3 percent pledge' aimed at reducing the budget deficit.

Market Instability and Tariff Confusion

Dalio's warnings come on the heels of recent stock market turmoil, sparked by plummeting tech stocks amid the uncertainty surrounding tariffs. Just last Friday, Trump's Customs and Border Protection agency exempted certain imports vital to the tech sector but quickly dashed hopes by hinting at imminent tariff reimpositions.

The lack of clarity around trade policy has left markets and industry leaders reeling. Key figures in the administration have been evasive about whether Trump’s tariff strategies are permanent or merely negotiation tactics, further complicating an already fragile economic environment.

A Long-Term Shift in American Industry?

Amidst all this chaos, experts note that these tariffs appear to signal a long-lasting structural shift in U.S. industry. Felix Stellmaszek from the Boston Consulting Group highlighted that government policies are likely guiding industries toward onshoring production, possibly altering the American economic landscape for years to come.

As tensions mount and economic indicators flash warning signs, one thing is clear: the stakes have never been higher for the U.S. economy, and the potential for disaster looms unless bold action is taken.

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

Česko (CS)

Česko (CS)

대한민국 (KO)

대한민국 (KO)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)

الإمارات العربية المتحدة (AR)

الإمارات العربية المتحدة (AR)