Bond Market Shake-Up: Long-Term Yields and Mortgage Rates Surge After Fed Rate Cut

2025-09-22

Author: Ting

Unexpected Fallout from Fed's Rate Cut

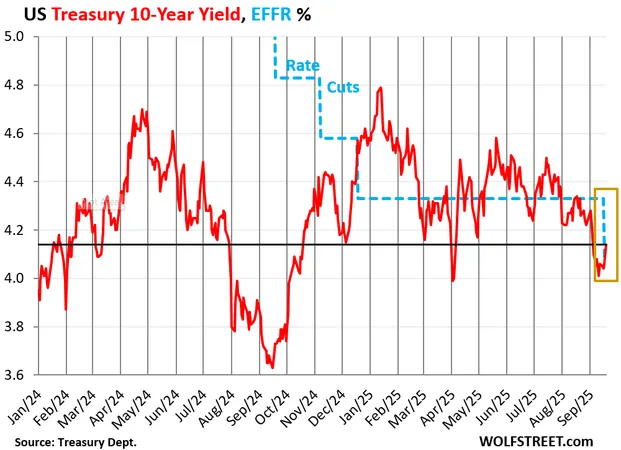

The bond market is reacting with jitters as inflation expectations and the influx of new bonds overshadow the Federal Reserve's recent rate cut. The 10-year Treasury yield closed at an unsettling 4.14% on Friday—an increase from its temporary dip below 4% earlier this month.

Recent Trends in Treasury Yields

After the Fed announced a 25-basis-point rate cut, the Effective Federal Funds Rate (EFFR) dropped to 4.08%. Historically, such cuts often lead to rising long-term yields, a trend we saw play out last year when a 50-basis-point cut sparked panic over inflation. As the Fed shifted to a more cautious approach this time, the bond market's reaction was less severe, yet concerns linger.

Diverging Yields: A Signal of Unease?

The 30-year Treasury yield ended the week at 4.75%, revealing a stark divergence from the EFFR. While the EFFR is influenced by short-term policy rates, the 30-year yield reacts to inflation expectations and the overall supply of new bonds. This pattern became evident as Treasury yields across various maturities surged following the rate cut.

Impacts on Mortgage Rates

Mortgage rates have spiked even more dramatically, with 30-year fixed rates jumping 22 basis points, reaching 6.35%. This increase is notable, especially given the backdrop of skyrocketing home prices that surged more than 50% in the past two years.

The New Normal in Housing Costs

Today's mortgage rates, while seemingly high, reflect a market readjusting to a post-bubble reality where prior rates were unsustainably low due to the Fed's aggressive monetary policies. The current environment highlights that the real issue isn't just the rates but the inflated housing market created by previous financial strategies.

What's Next for the Bond Market?

The bond market remains on edge; if inflation continues its upward trajectory, the consequences could be significant, potentially leading to even higher long-term yields. As we stand at the crossroads of monetary policy and economic performance, investors are keenly watching indicators to gauge the Fed's next move.

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

Česko (CS)

Česko (CS)

대한민국 (KO)

대한민국 (KO)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)

الإمارات العربية المتحدة (AR)

الإمارات العربية المتحدة (AR)