Bitcoin Soars Past $88,000 as Stock Markets Smash Records in Post-Election Surge!

2024-11-11

Author: Yan

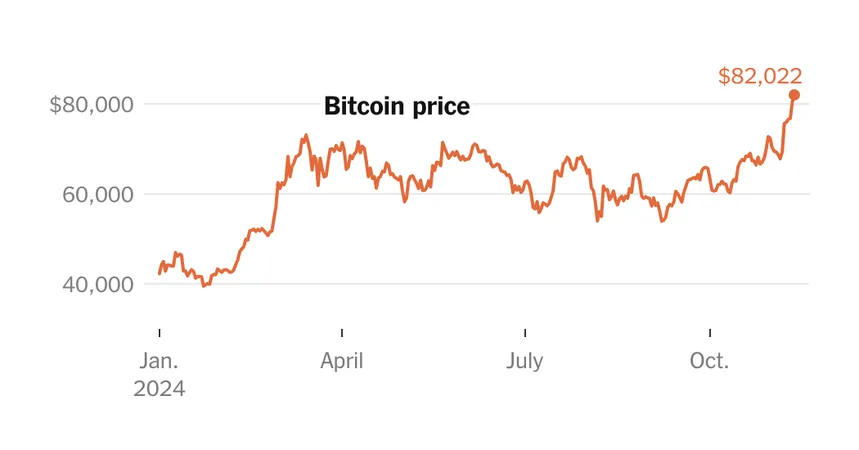

In an exhilarating turn of events, Bitcoin has skyrocketed past the $88,000 mark for the first time ever, with major stock indexes also breaking records this Monday. The remarkable rally comes on the heels of Donald J. Trump's election victory last week, igniting investor optimism across various markets.

On the stock front, the S&P 500 edged up by 0.1 percent, marking a historic close above 6,000 for the first time, while the Dow Jones Industrial Average surged 0.7 percent to an impressive 44,293. Meanwhile, Bitcoin experienced a dramatic increase, soaring more than 10 percent on the same day, reaching over $88,700.

This bullish trend has been largely fueled by expectations of pro-business policies anticipated from a second Trump administration. Investors are banking on tax cuts, deregulation, and a relaxation of enforcement targeting cryptocurrencies, which many believe could further elevate asset prices, including stocks and digital currencies.

The phenomenon isn't entirely surprising. Following major political events like presidential elections—especially ones that conclude without controversy—markets typically see a positive uptick. However, the current surge is a part of a broader trend colloquially known as the "Trump trade," which has encapsulated a variety of asset classes.

Despite the excitement, caution remains among some investors regarding possible inflation resurgence. Concerns are mounting that if the incoming administration's campaign promises materialize, we could witness rising interest rates and increased borrowing costs for the government, potentially cooling down this market frenzy. It's worth noting that the bond market was closed on Monday in observance of Veterans Day.

Bitcoin’s meteoric rise is particularly notable in light of recent endorsements from Trump himself. In the lead-up to the election, Trump actively promoted World Liberty Financial, a cryptocurrency venture in which several members of his family have vested interests.

The cryptocurrency industry has been a significant player in this election cycle, pouring millions into political campaigns. High-profile crypto figures, including Tyler and Cameron Winklevoss, founders of the Gemini crypto exchange, were notable supporters of Trump's campaign, contributing substantial donations. Additionally, various super PACs raised over $100 million to support congressional candidates who favor pro-crypto policies, highlighting the growing influence of digital currencies in American politics.

As we navigate this new financial landscape, investors are left anticipating how these developments will shape not only their portfolios but also the broader economic environment in the coming months. Will Bitcoin continue its ascent, or will market dynamics shift as inflation concerns come to the forefront? One thing is for certain: the stakes have never been higher!

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)