Asian Stocks Plummet Amidst US Market Losses: What Investors Need to Know

2024-12-30

Author: Lok

In a surprising turn of events, Asian stock markets have experienced a significant decline following recent losses in US markets. As traders react to the latest economic data and geopolitical tensions, concerns have mounted about the potential for a global economic slowdown.

Investors had hoped for a rebound after a shaky year, but with the Dow Jones Industrial Average and S&P 500 reporting substantial losses, Asian markets mirrored this trend. Major indices across Japan, Hong Kong, and South Korea have plunged, driven by fears of rising interest rates and inflationary pressures that could dampen economic growth.

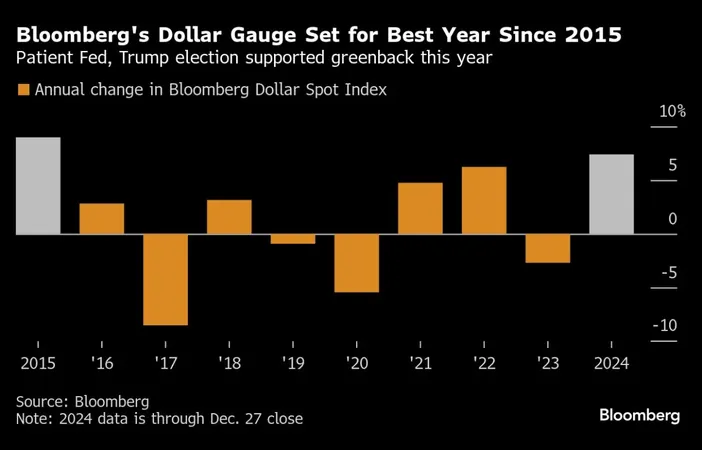

Analysts suggest that the ongoing uncertainty surrounding the US economy, particularly in light of the Federal Reserve's tightening policies, is prompting a cautious approach among investors. Wall Street’s losses have sent ripples across financial markets worldwide, highlighting the interconnectedness of global economies.

Additionally, geopolitical factors, including escalating tensions in Eastern Europe and the ongoing trade disputes between the US and China, are contributing to the bearish sentiment. Traders are now reassessing their investment strategies ahead of critical economic indicators expected to be released later this week.

Could these declines signal a turbulent road ahead for investors? As uncertainty looms, it may be wise for investors to consider diversifying their portfolios and staying informed about emerging market trends.

Stay tuned for more updates on this evolving situation, as the financial world is bracing for what comes next.

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

Česko (CS)

Česko (CS)

대한민국 (KO)

대한민국 (KO)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)

الإمارات العربية المتحدة (AR)

الإمارات العربية المتحدة (AR)