Americans Face Disheartening Decline in Consumer Confidence Amid Inflation Woes

2024-09-24

US Consumer Confidence Hits Three-Year Low

US consumer confidence has hit a dismal low not seen in three years, as Americans continue to struggle with rampant inflation and an uncertain job market. The Consumer Confidence Index saw a concerning drop of 6.9 points in September, plunging to 98.7—marking the most significant decline since August 2021, as revealed in a recent report by The Conference Board.

Economists Surprised by Downturn

This downturn comes as a shock to economists, falling well short of the expectations highlighted in a Bloomberg survey. Many consumers have cited escalating prices and persistent inflation as key factors shaping their negative perceptions of the economy.

Age and Income Groups Most Affected

The most dramatic declines in consumer confidence were reported among individuals aged 35 to 54 and those earning less than $50,000 a year. Although inflation seems to be easing slightly, prices remain over 16% higher compared to three years ago, raising concerns among consumers about job security amidst an increasingly volatile economic climate.

Experts Comment on Job Security and Economic Sentiment

Cody Moore, head of growth strategies at Wealth E&P, expressed the gravity of the situation: “Consumers are feeling the pinch not only from rising costs but are also anxious about their job stability, particularly with the uncertainty surrounding the forthcoming elections.”

Dana Peterson, chief economist at The Conference Board, added that this drop in consumer sentiment likely correlates with challenges in the job market, including reduced working hours and sluggish payroll growth. Despite a generally healthy labor market characterized by low unemployment and high wages, the perception of fewer job openings is weighing heavily on consumer attitudes.

Federal Reserve's Interest Rate Cut May Not Provide Immediate Relief

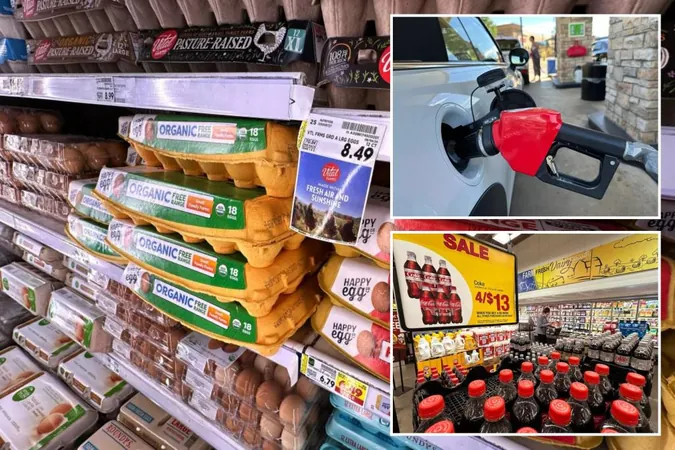

The Federal Reserve recently implemented a half-percentage-point cut to interest rates, yet these modifications may not provide immediate relief to consumers. Kenin Spivak, CEO of SMI Group, pointed out that, while interest rates have fallen, the effects might take time to trickle down. “Food prices, gas, and other essentials continue to rise, and it will take a while before consumers feel the impact of lower credit card and mortgage rates,” he explained.

Declining Future Expectations and Economic Concerns

Further illustrating the precarious situation, expectations for the next six months took a dive, declining by 4.6 points to 81.7—a threshold often associated with recession fears. Additionally, the index measuring current economic conditions fell sharply by 10.3 points to 124.3. Only 30.9% of consumers expressed optimism about job availability, reflecting the longest sustained decline since the 2008 financial crisis.

Personal Finance Challenges Highlighted

The current economic landscape is riddled with personal finance issues. Ted Jenkin, co-founder of oXYGen Financial, noted concerning trends, including that 50% of Americans have yet to resume student loan payments, auto loan delinquencies reaching a 20-year high, and total personal credit soaring to a staggering $1.14 trillion.

Essential Expenses Significantly Pricier

Ken Mahoney, CEO of Mahoney Asset Management, highlighted essential expenses—food, housing, gas, and electricity—as being significantly pricier than just a few years ago. "These developments may signal troubling trends in the job market," he warned, "but we need more data to understand the full picture."

Impact of Rate Cuts and Consumer Anxiety

As the effects of the Federal Reserve’s recent rate cuts take time to materialize—often up to 30 days for credit cards and auto loans, and up to 90 days for mortgages—many Americans remain understandably apprehensive about their financial futures. There even appears to be a slight increase in the number of consumers who believe the economy is currently in a recession, signaling growing anxiety.

Conclusion and Future Outlook

In a time of uncertainty, these sentiment shifts not only highlight the immediate concerns facing everyday Americans but also foreshadow what could be a challenging economic journey ahead. Stay tuned for updates as we monitor this developing situation!

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)