5 Critical Updates Before the Stock Market Opens Today

2024-11-08

Author: Wei

5 Critical Updates Before the Stock Market Opens Today

As the stock market gears up for another day of trading, several key developments are shaking up investor sentiment. With stock futures mostly pointing down, the flare from recent elections dims, especially following the Federal Reserve's anticipated interest rate cut. Here’s what you need to know before the market opens:

1. Mixed Market Signals as Momentum Wanes Post-Rate Cut

Following the excitement generated by the midterm elections, market momentum appears to be slowing. As of this morning, Nasdaq futures have dipped by 0.3%, while S&P 500 futures are also declining from their recent all-time highs. Dow futures remain relatively stable. This pause in growth comes in light of the Federal Reserve's decision to cut interest rates, which has led to Treasury yields easing slightly and Bitcoin maintaining a steady position around $76,000. Notable declines include Trump Media, which fell over 4% in pre-market trading after a staggering drop of more than 23% the previous day. Meanwhile, Tesla shares also showed slight declines after their previous rally.

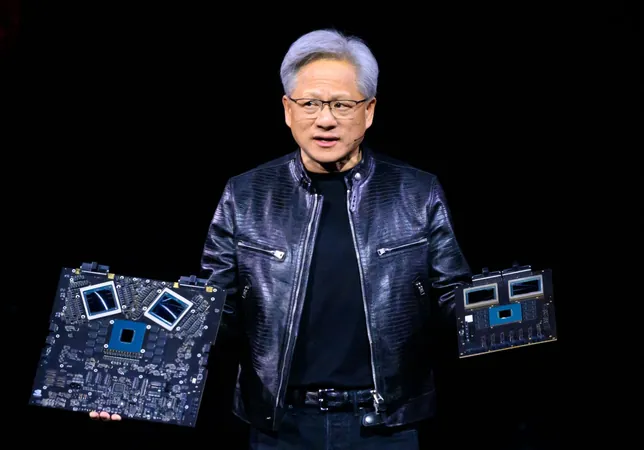

2. Nvidia and Sherwin-Williams Join the Dow Jones Industrial Average

In a significant shift, Nvidia (NVDA), now the most valuable company globally due to soaring demand for its AI chips, is joining the Dow Jones Industrial Average today, replacing struggling Intel (INTC), which has seen nearly a 50% decrease in stock value this year as it restructures. Additionally, Sherwin-Williams enters the Dow, taking the place of chemical powerhouse Dow (DOW). Interestingly, Nvidia's shares are down slightly in premarket trading, whereas Sherwin-Williams remains steady.

3. Arista Networks Takes a Hit on Gross Margin Decline

Shares of Arista Networks (ANET) fell more than 4% in pre-market trading after the cloud networking company reported a slight downturn in gross margins, posting 64.2% compared to 64.9% from the previous quarter. However, the company still reported strong net income of $747.9 million — a significant year-over-year increase. They also announced plans for a stock split on December 4, which could attract more investors looking for shares at a lower price point.

4. Airbnb Faces a Significant Drop in Net Income

Airbnb (ABNB) shares took a nosedive by over 6% following the announcement that net income dropped drastically to $1.37 billion for this quarter, a stark contrast to the $4.37 billion reported a year earlier. This decline has surprised analysts who had anticipated better performance. On the plus side, their third-quarter revenue of $3.73 billion exceeded expectations, with Nights and Experiences Booked up by 8% year-over-year.

5. DraftKings Shares Decrease After Revising Financial Outlook

DraftKings (DKNG) saw its shares fall sharply as the company slashed its full-year income and revenue estimates due to a disappointing start to the fourth quarter. The downward revision has raised concerns among investors about the company's growth trajectory, especially in a competitive market poised for year-end spikes.

Final Takeaway: Navigating Through Market Turbulence

With mixed signals and varying performances across major players, today's trading session promises to be volatile. Investors should brace for impacts stemming from the Federal Reserve's latest moves, corporate earnings declines, and shifts in major indices. As always, keeping an eye on economic indicators and company performance will be crucial in making informed investment decisions.

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)