Why Keeping Your Investment Strategy Under Wraps Might Just Make You Richer

2025-06-09

Author: Michael

The Unexpected Rule of Investment Success

Sam Sivarajan, a prominent keynote speaker and independent wealth management consultant, is set to unveil his upcoming book on succeeding in a world marked by uncertainty. In a surprising twist reminiscent of the famous line from *Fight Club*, he proposes that the first rule of successful investing might just be: Don't talk about investing.

The Digital Investment Frenzy

Every significant market event triggers a flurry of online activity. Following any major economic announcement, social media—particularly platforms like X, StockTwits, and Reddit—erupts with opinions, analysis, and calls to action. While this chaotic exchange seems to foster informed decision-making, startling new research suggests that the most successful investors might be those who resist the digital chatter.

Study Reveals the Real Dynamics Behind Market Movements

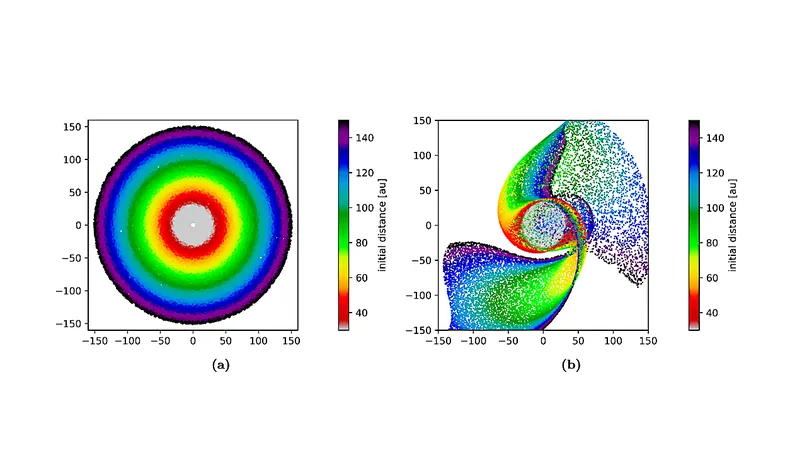

A compelling study from March 2025 analyzed vast amounts of social media content over nearly a decade. The researchers uncovered critical differences between two key concepts: sentiment and attention. Sentiment refers to the mood of online posts—are they optimistic or pessimistic? Attention measures how much chatter surrounds investing, irrespective of its tone.

Here's where it gets fascinating: These two elements predict opposite outcomes in the market.

High Sentiment vs. High Attention: What’s the Difference?

When social media buzzes with bullish sentiment, the market tends to rise—initially. However, this excitement is often short-lived; the study found that periods of high sentiment are typically followed by declines within 20 trading days. In contrast, an uptick in conversation (high attention) often signals ongoing market distress. More chatter usually means trouble ahead.

The Psychological Trap of Social Media

The study revealed that significant market drops tend to ignite both plunging sentiment and soaring attention, suggesting that periods of stress are often accompanied by a pessimistic mood and increased discussion. Fear and uncertainty, it seems, drive engagement far more effectively than optimism.

Turning Internet Noise into Investment Strategy

Armed with these insights, researchers devised a dynamic investment strategy leveraging social media signals. Over nine years, this method yielded an impressive annual return exceeding 4.6 percentage points compared to traditional fund managers and historical averages.

Don’t Get Caught in the Noise!

This doesn't mean investors should shut themselves off from all information. The key takeaway? The constant stream of online investment opinions often clouds judgment. Real success lies in disciplined analysis and patient observation.

Key Lessons for Aspiring Investors

To sharpen your investment acumen, keep these three strategies in mind:

1. **Recognize Market Tops:** When sentiment peaks, it's often a red flag signaling potential downturns.

2. **Decipher Attention vs. Information:** Just because everyone is talking about something doesn’t mean it poses an investment opportunity.

3. **Cultivate Anti-Social Media Habits:** Limit investment-focused social media consumption during turbulent times. Successful investors usually focus more on thorough analysis rather than daily social media noise.

Silence Can Be Golden

When your social feeds are overwhelmed with urgent investment advice, remember: sometimes, the best response is to step back and do nothing. In an era filled with information overload, the art of remaining silent could be your greatest investment strategy. As investment legend John Bogle famously said, 'Don’t do something, just stand there!'

Navigating the financial markets successfully might just be about knowing when to speak—and when to stay silent.

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

Česko (CS)

Česko (CS)

대한민국 (KO)

대한민국 (KO)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)

الإمارات العربية المتحدة (AR)

الإمارات العربية المتحدة (AR)