Trump Stands Firm on Tariffs Despite Financial Turmoil - What It Means for the Economy

2025-04-07

Author: Jacob

Trump's Stance on Tariffs

In the wake of a significant plunge in global stock markets, U.S. President Donald Trump has declared that his administration has no plans to pause tariffs. This declaration comes despite growing concerns that these tariffs could precipitate a global economic downturn.

Press Briefing Highlights

During a press briefing in the Oval Office, Trump emphasized, "We’re not looking at that. We have many, many countries negotiating deals with us, and they’re going to be fair deals. In some cases, they will be paying substantial tariffs." He addressed inquiries regarding the conflicting signals from his own administration about the potential for negotiations, stating, "Both can be true. There could be permanent tariffs and still open negotiations."

Economic Impact and Stock Market Response

On that very day, major markets in Europe and Asia suffered dramatic losses. The Dow Jones Industrial Average dropped by 349 points, or 0.9%, while the S&P 500 experienced a decline of 0.2%. The volatility has raised questions regarding Trump's ultimate objectives in his ongoing trade war. Analysts speculate on whether his intentions are to strike better trade deals with other countries, which could lead to reducing tariffs and preventing recession, or if he aims for a longer-term economic overhaul with persistent tariffs, potentially resulting in further declines in stock prices.

Concerns from Economic Experts

Billionaire Trump supporter Bill Ackman voiced his fears over the economic situation, dubbing it an "economic nuclear winter" and advocating for a 90-day pause on tariffs. He urged the President to "call a time out" to address the tariff imbalances.

Market Reaction and International Impact

The sell-off in the stock market was triggered by Trump's announcement of higher U.S. import taxes and China's retaliatory actions, which sharply drove down market values. The turmoil continued as Trump hinted at imposing additional tariffs on China unless they retracted their planned retaliatory measures.

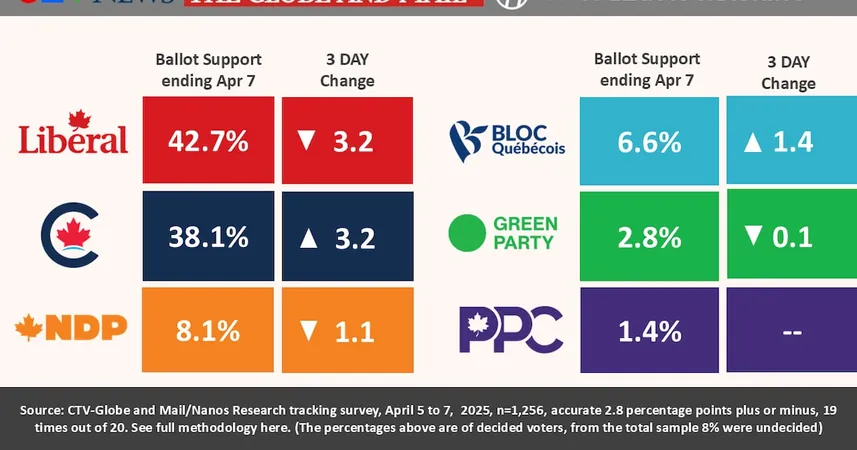

Canada's Situation amidst Tariffs

While Canada has been spared from the latest tariff increases, it still grapples with existing levies on key exports like steel and aluminum and has imposed retaliatory tariffs on numerous American products. Meanwhile, the Canadian dollar's exchange rate showed slight fluctuations amid the chaos.

Global Market Declines

International markets were equally impacted, with Japan's Nikkei 225 crashing by 7.8% on Monday, and major European indices like Germany's DAX and France's CAC 40 also plummeting by significant margins. The aftermath of Trump's announcement has set off a wave of instability, leading to mixed results on market indexes characterized by rapid swings first between loss and gain, and then back again as rumors of a potential tariff pause circulated but were quickly denied.

Analysis from Deutsche Bank

Analysts from Deutsche Bank expressed concerns that there is no clear bottom in sight for the troubled markets. Trump, while stating he does not want the markets to drop, has shown indifference to the sell-off, highlighting that "sometimes you have to take medicine to fix something."

Sector-Specific Effects

The consequences of these tariffs are being felt across various sectors. For instance, Nike shares dropped 4%, impacted by its manufacturing presence in China, which accounted for a significant portion of its footwear production.

Conclusion and Future Outlook

As Trump continues to push forward with his tariffs, the broader implications on the global economy remain uncertain. The devastating impact of trade barriers on market stability is prompting investors to speculate whether the Federal Reserve will intervene with interest rate cuts to mitigate potential damage.

All indicators suggest that the financial pain inflicted by these economic policies is far from over. With uncertainty looming, many are left asking: what will be the ultimate cost of Trump's unwavering stance on tariffs? The situation remains fluid, and any announcements or negotiations could drive market reactions even further.

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

Česko (CS)

Česko (CS)

대한민국 (KO)

대한민국 (KO)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)

الإمارات العربية المتحدة (AR)

الإمارات العربية المتحدة (AR)