TC Energy Slashes Cost Estimates for Southeast Gateway Pipeline Project, Poised for Success by Mid-2025!

2024-11-07

Author: William

Introduction

TC Energy Corp. is making headlines as its Southeast Gateway pipeline project in Mexico is set to come in a staggering 11% under budget, with completion anticipated by mid-2025. The recent announcement from the Calgary-based energy giant reveals a revised cost estimate of US$3.9 billion, down from an earlier projection of US$4.1 billion.

Project Overview

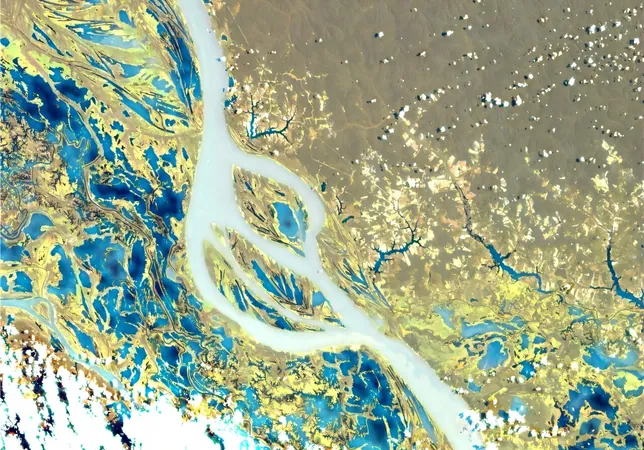

The Southeast Gateway project, approved in 2022, entails the construction of a monumental 715-kilometer offshore natural gas pipeline that will transport essential resources across southeast Mexico. In a conference call with analysts, CEO Francois Poirier attributed the cost reduction to 'really good project execution.' He highlighted the procurement of materials and equipment at lower rates than expected, along with improvements in construction efficiency.

CEO's Insights

Poirier declared, 'We’re on schedule to reach mechanical completion by late 2024 or early 2025, with a commercial start no later than mid-2025.' This optimistic update bodes well for TC Energy, which has recently faced scrutiny over its substantial debt and the escalating costs associated with the Coastal GasLink project—a massive 670-kilometer pipeline that encountered significant financial overruns.

Challenges with Coastal GasLink

Coastal GasLink, intended to carry natural gas from Western Canada to Kitimat, B.C., saw its budget swell dramatically from an initial estimate of C$6.2 billion to a jaw-dropping C$14.5 billion during construction, raising concerns among investors.

Financial Stabilization Efforts

In light of these challenges, TC Energy has been actively working to stabilize its financial standing. On Thursday, Poirier shared that the company achieved a significant milestone by slashing long-term debt by C$7.6 billion in October, leveraging proceeds from asset sales and a strategic spinoff of its oil pipeline business, now known as South Bow Corp.

Future Outlook

Thanks to these successful efforts and the cost efficiencies from the Southeast Gateway project, TC Energy is confident in reaching its year-end net debt target. Despite a cautious approach towards future capital expenditures, the company remains alert to burgeoning opportunities within its natural gas division.

Market Predictions

Looking ahead, TC Energy anticipates a 'surge in demand' for natural gas across North America by 2035, driven by the retirement of coal plants, increasing electricity needs from AI technologies and data centers, as well as rising liquefied natural gas exports.

Financial Performance

In financial terms, TC Energy bounced back with a third-quarter profit of C$1.46 billion—or C$1.40 per share—compared to a loss of C$197 million or 19 cents per share in the same period last year. Revenue for the third quarter reached C$4.08 billion, a notable increase from C$3.94 billion in 2022. Analysts had predicted earnings of 95 cents per share, which TC Energy comfortably surpassed with a figure of C$1.03 per share.

Conclusion

With these promising developments, TC Energy is positioning itself as a formidable player in the energy sector, showing resilience amidst challenges and an optimistic outlook for the future!

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)