Tariff Impacts on Canada: Winners and Losers Emerged Amid Trade Tensions

2025-04-02

Author: Jacques

Experts warn that U.S. tariffs could significantly disrupt the Canadian economy, potentially triggering a recession. However, while some industries may face downturns, others could benefit from shifts in consumer behavior and domestic market dynamics.

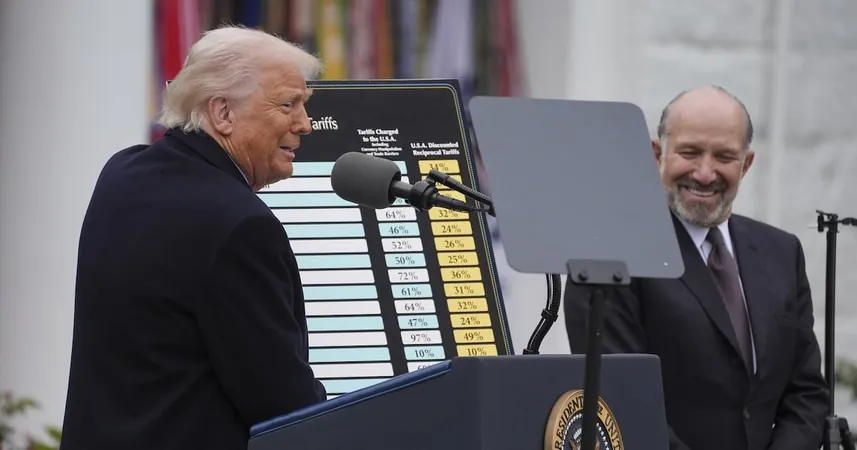

During a recent announcement, U.S. President Donald Trump introduced his "liberation day plan," detailing tariffs on goods from various countries. According to a White House fact sheet, Canada and Mexico were exempted from certain new tariffs, but Trump intends to impose a hefty 25% tariff on all foreign-made automobiles. This looming financial impact raises concerns among economists regarding the broader implications for Canada.

RSM Canada Economist Tu Nguyen pointed out in an interview with BNNBloomberg that these tariffs could indeed generate a recessionary environment in Canada. Despite the overall negative outlook, specific sectors might benefit from a surge in local purchasing sentiments spurred by patriotic consumer trends and the potential removal of long-standing interprovincial trade barriers.

Winners: Retail Sector Buoys Canadian Economy

Nguyen emphasized that retail stores could experience a shift in consumer spending habits as Canadians increasingly prefer locally made products. This sentiment has already been reflected in supermarkets and retail outlets, which are labeling locally sourced goods with a "Made in Canada" tag. Notably, Canadian alcoholic beverages stand to benefit significantly from potential restrictions on American imports.

While enthusiasm for 'buy local' has surged, some analysts, such as Michael Dobner from PwC Canada, express skepticism about its longevity, particularly for high-ticket items. Nonetheless, for smaller products, the shift toward local brands may establish a more enduring trend.

Winners: Tourism Industry Thrives on Domestic Travel

In an intriguing twist, Canada’s tourism sector is experiencing a unique shift as Canadians opt for domestic vacations rather than heading south. As Nguyen puts it, this trend is likely to foster growth in Canadian domestic tourism. Interestingly, American tourists continue to flock to Canada, undeterred by escalating trade tensions. Additionally, a weaker Canadian dollar makes the country an even more attractive destination, promising to boost tourism during peak seasons.

Winners: Finance Sector Remains Resilient

Interestingly, it appears that Canada’s finance sector is less likely to feel the adverse effects of tariffs. Nguyen noted that financial institutions might even benefit from increased demand for services that help businesses navigate the evolving regulatory landscape. The service industry, particularly finance, typically fares better during economic fluctuations, albeit no sector is entirely insulated from a potential recession.

Losers: Automotive Industry Faces Major Challenges

On the flip side, the automotive industry stands out as a sector poised for significant setbacks. With close ties to U.S. supply chains, Canadian automakers could suffer greatly from the new tariffs. Nguyen highlighted that the daily cross-border movement of car parts could incur additional costs, raising vehicle prices and potentially forcing some manufacturers to halt operations.

Experts like Derek Benedet from Purpose Investments have expressed deep concerns over this industry, noting that a staggering 85% of vehicles manufactured in Canada are destined for the U.S. market. Consequently, the impact of a 25% tariff on foreign cars could be detrimental not just to Canadian producers but also to U.S. consumers facing higher prices.

Losers: Real Estate Market Under Strain

Despite expectations for an upward trend in home prices due to a decline in interest rates, Nguyen cautioned that fear of recession and job insecurity might stifle consumer confidence and hinder the real estate market's recovery. Traders in the housing sector may experience challenges as tariffs are likely to drive construction costs higher, making it difficult for prospective buyers to enter the market.

Overall, as global trade dynamics shift, various industries in Canada will face different challenges and opportunities. While some sectors adapt and thrive amidst tariffs, others may struggle to maintain stability in an uncertain economic landscape. The question remains: how will these trends evolve in the coming months? Buckle up, as the unfolding repercussions of these tariffs could reshape the Canadian economy like never before!

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

Česko (CS)

Česko (CS)

대한민국 (KO)

대한민국 (KO)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)

الإمارات العربية المتحدة (AR)

الإمارات العربية المتحدة (AR)