Stock Market Plunge as Jerome Powell Signals Caution on Rate Cuts

2024-11-15

Author: Jacques

Stock Market Overview

The stock market experienced a steep decline this week, with the S&P 500 heading towards its worst performance in over two months. This drop can be attributed to waning enthusiasm over the “Trump trades” and a growing acknowledgment among investors that the Federal Reserve may not expedite interest rate cuts.

Market Performance

The S&P 500 fell approximately 1.5%, while the tech-heavy Nasdaq 100 dropped over 2%. All major tech stocks, dubbed the "Magnificent Seven," experienced losses except for Tesla, which managed to remain afloat. Notable declines occurred in Amazon, Nvidia, and Meta Platforms, all of which slid by more than 3%. In a major setback, Applied Materials, the leading U.S. manufacturer of chip-making equipment, saw its shares plummet following an unfavorable revenue forecast.

Investor Sentiment

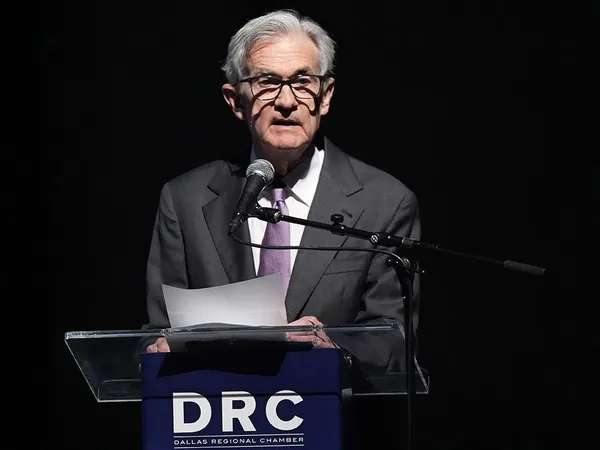

Investor sentiment shifted, with traders now estimating just above a 50% likelihood of a quarter-point rate cut at the Fed's December meeting, a significant decrease from the 80% predicted earlier in the week. This adjustment came after Fed Chair Jerome Powell's remarks on Thursday, wherein he indicated that the central bank is in no rush to decrease interest rates. Adding to this cautious outlook, Boston Fed President Susan Collins reinforced that the timing of any rate cuts would depend heavily on forthcoming economic data.

Analysts' Concerns

Financial analysts are expressing concerns about the market's valuation, noting that Powell's comments about a gradual approach to rate cuts are contributing to the sell-off. John Davi, CEO and CIO at Astoria Advisors, noted, “The higher rates go, the more equity risk premiums tilt in favor of bonds,” suggesting that as rates rise, equities become less appealing in comparison to fixed-income investments.

Sector Impact

Adding to the market's turmoil, pharmaceutical giants Moderna and Pfizer faced pressure after Trump appointed notable vaccine skeptic Robert F. Kennedy Jr. to a senior health-policy position, stirring uncertainty in the health sector.

Currency and Crypto Trends

The U.S. dollar slightly retreated from two-year highs but remained on track to achieve its seventh consecutive weekly gain. Additionally, another segment of the "Trump trades," Bitcoin, has retracted some of its recent surges, trading below $90,000 after recently soaring above $93,000, fueled by hopes of favorable cryptocurrency policies from the new administration.

Conclusion

As the economic landscape continues to shift, investors are left grappling with the implications of policy changes and the potential for inflation, leading to a turbulent market environment. The coming weeks will be crucial as traders await further data that could sway the Federal Reserve's decision-making.

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)