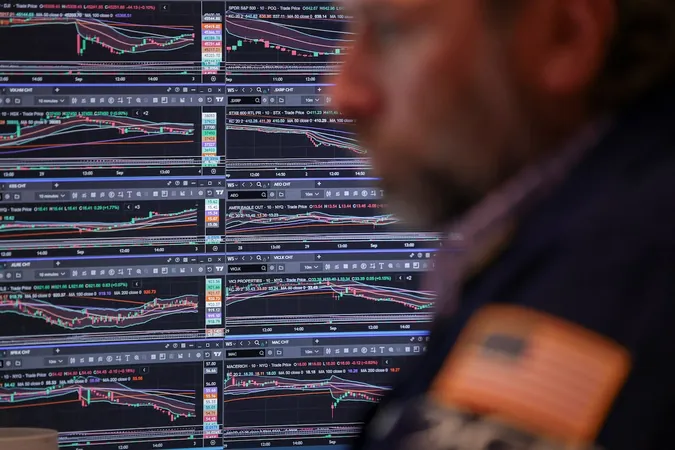

Soaring TSX Nears Record High as Investors Anticipate Key Economic Data

2025-09-04

Author: Emma

TSX on the Brink of Breakthrough

Canada's primary stock market index, the S&P/TSX composite, is on the verge of a record-breaking moment, edging up by 0.03% to reach 28,760.46. This uptick comes as investors eagerly await crucial employment data, which could significantly impact the Bank of Canada's upcoming interest rate decisions.

Record Highs Amid Economic Anxiety

Following a disappointing GDP report revealing a sharper-than-expected contraction in Canada's economy, the TSX has celebrated three consecutive record closing highs since last Friday. This downturn has fueled speculation of a possible rate cut, as investors absorb the implications for economic policy.

Big Jobs Report on the Horizon

Both Canada and the U.S. are set to release their August employment reports this Friday, promising to shape monetary policy debates. Economists predict that Canada added about 10,000 jobs, with the unemployment rate inching up to 7% from 6.9%.

Market Analysts Weigh In

Martin Pelletier, senior portfolio manager at TriVest Wealth Counsel, suggests that the global economic landscape is shifting, with both Canada and the U.S. bracing for potential cuts in interest rates. He emphasized Canada's vulnerability due to ongoing trade disputes, urging the Bank of Canada to make prudent adjustments.

Investor Sentiment and Predictions

With financial markets predicting a 67.6% probability of a 25-basis-point cut by September 17, attention is firmly fixed on the unfolding economic landscape.

Sector Movements: Tech Rises, Commodities Fall

The technology sector on the TSX saw a notable rise of 0.8%, driven by a strong performance from Descartes, which reported robust quarterly revenue figures. However, commodities stocks, particularly those focused on materials and energy, fell 0.5% each, closely tracking declines in oil and gold prices.

Wall Street's Mixed Signals

In the U.S., Wall Street's leading indexes remained steady after a lackluster private payrolls report, while Salesforce faced an 8% drop following an underwhelming revenue forecast. This highlights a key shift in market sentiment, with traders bracing for Friday's essential nonfarm payrolls data.

Economic Advisories Impacting the Fed's Stance

The upcoming testimony of economic adviser Stephen Miran before a Senate confirmation hearing is another focal point, as investors look for signals on Federal Reserve policies.

Historical Context of September's Performance

September typically brings mixed results on Wall Street, with the S&P 500 historically averaging a 1.5% loss since 2000. As the month begins amid rising Treasury yields, investors remain cautious yet optimistic.

Diverging Tech Stocks and Optimism Ahead

While AI-powered companies have propelled indices to record heights this year, their momentum has recently slowed due to valuation concerns. Nevertheless, notable gains from Amazon and Meta Platforms have been promising for the consumer discretionary sector.

Market Indicators and Trends

The S&P 500 recently marked seven new 52-week highs and six lows, while the Nasdaq Composite recorded 42 highs and 85 lows, emphasizing the ongoing volatility within the markets.

As investors remain vigilant, all eyes are on the forthcoming reports that could further shape the financial landscape in Canada and beyond.

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

Česko (CS)

Česko (CS)

대한민국 (KO)

대한민국 (KO)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)

الإمارات العربية المتحدة (AR)

الإمارات العربية المتحدة (AR)