Seize the Moment: Why Now is the Perfect Time to Invest in CGI Group Amid Trade Turmoil

2025-03-10

Author: Jacques

As the trade war escalates, investors are left grappling with uncertainty. Each day brings a new wave of questions regarding which products will be hit by tariffs and at what rates. The lack of clear direction from U.S. policymakers, including President Donald Trump, has left both consumers and businesses wondering about the duration and impact of this economic conflict.

During a recent address, Trump conveyed a bullish outlook for the U.S. economy, predicting that this tumultuous period would ultimately pave the way for a new "golden age" of job creation driven by significant investment influx. Yet, the swift changes in tariff policies suggest a haphazard execution that undermines the stability of global trade relations.

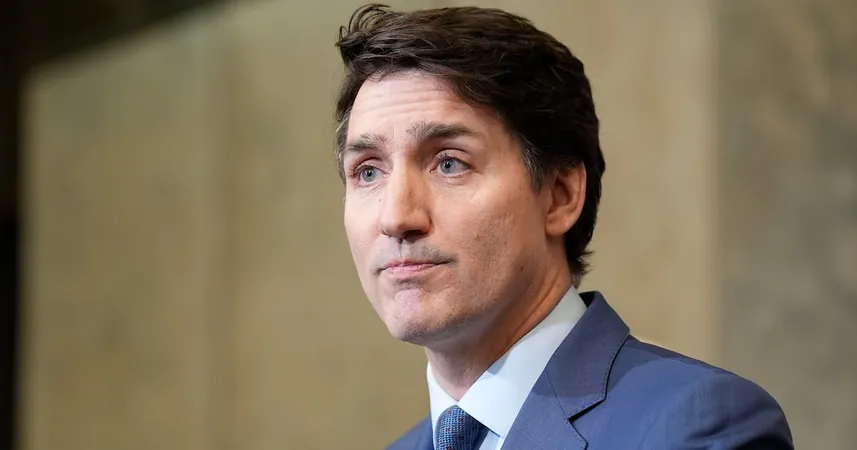

Meanwhile, leaders from both Canada and the U.S. are scrambling to decipher the potential ramifications of these tariffs, leading to an atmosphere of anxiety in stock markets. As of last Friday, the S&P/TSX Composite Index recorded a 2.5% drop, with notable declines across U.S. indexes, including the Nasdaq, now in correction territory.

In times of crisis, however, there are always opportunities to be found. Historical events like the Great Financial Crisis of 2007-2009 have taught investors that market dips often lead to significant gains for those willing to take a risk. Stocks of reputable companies can become undervalued, presenting an ideal climate for budding investors.

One company that stands out during this turbulent time is CGI Group (GIB.A-T). Less than a month ago, CGI reached an all-time high, but a wave of profit-taking paired with heightened recession fears has caused its shares to decline. Now may be a prime opportunity for astute investors to consider adding this strong tech giant to their portfolios.

Company Overview: CGI Group

Founded in 1976 and headquartered in Montreal, CGI Group is a formidable player in the IT and business process services arena, employing approximately 91,000 professionals globally. With a diverse range of offerings that includes IT consulting, systems integration, and outsourcing services, CGI is well-poised to navigate through economic challenges.

Performance and Recent Developments

CGI recently reported its first-quarter 2025 results, matching analysts' forecasts with revenues nearing $3.8 billion, marking a year-over-year increase. The company boasts a significant backlog of $29.76 billion—equivalent to twice its annual revenue—indicative of strong future earnings potential. CEO François Boulanger highlighted a robust demand for digitization services, including advancements in AI, with bookings surpassing $4.1 billion.

Future Growth Potential

CGI's strategy involves aggressive growth through acquisitions, the latest being the acquisition of BJSS, a prominent U.K.-based tech consultancy. This move aligns with the company's aim to enhance its consulting services while leveraging cloud, AI, and data analytics solutions.

Moreover, CGI has initiated a quarterly dividend of 15 cents per share and is seeking approval for a buyback program, indicating a strong commitment to returning value to shareholders.

As the trade war continues to cause ripples across financial markets, CGI appears resilient, with little direct exposure to the conflict and a diversified global footprint. Although it may face some short-term pressure due to broader market conditions, the company's solid fundamentals and growth strategies position it favorably for a market rebound.

Investors should keep a keen eye on CGI Group as a potential beacon of stability and growth amid ongoing economic uncertainty. Is now the time to jump on this tech titan? The clues are there—make your move before it’s too late!

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

Česko (CS)

Česko (CS)

대한민국 (KO)

대한민국 (KO)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)