Oil Prices Plummet as Trump Takes Office Again: What You Need to Know!

2025-01-21

Author: Olivia

As Donald Trump returns to the White House for an unprecedented second term, markets are buzzing, and oil prices are feeling the heat. Just before Trump’s inauguration, crude oil prices dropped significantly, primarily driven by expectations of a stronger dollar and shifting trade policies.

On his first day, Trump made headlines by signing an executive order to withdraw from the Paris Climate Agreement. This move, alongside directives to the Energy Department to lift a freeze on new LNG export permit applications, has sent shockwaves through the market, fostering bearish sentiment among traders.

In a controversial pivot, Trump also announced the intent to repeal the 2021 Biden electric vehicle mandate, which aimed for a 50% electric vehicle target by 2030. By hinting at the potential elimination of electric vehicle tax credits, Trump is stirring up uncertainty in the green energy sector.

In a twist for oil inventories, while US crude stocks, excluding the Strategic Petroleum Reserve, have hit a low of 412 million barrels (the lowest since April 2022), Trump aims to fill US stockpiles 'back to the very top.' This overly ambitious target raises questions about how this will influence demand and supply dynamics in the oil market.

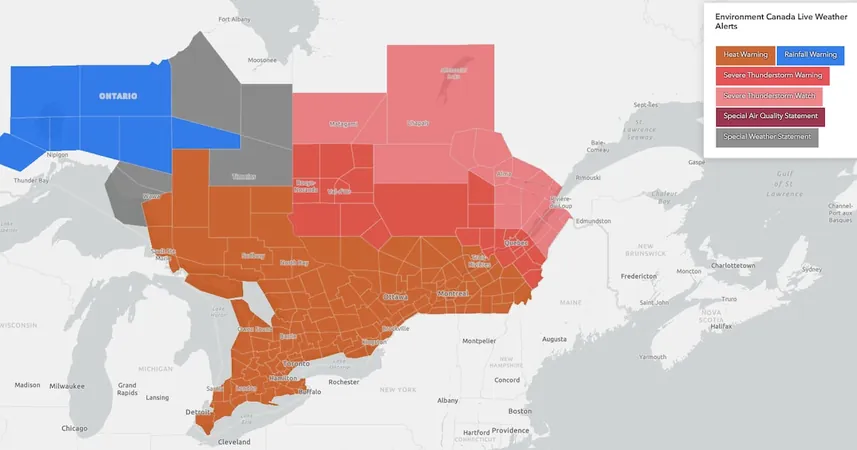

In an early sign of upcoming trade tensions, Trump refrained from imposing 25% tariffs on Canadian and Mexican imports, but warned that punitive measures could be on the table as soon as February 1. This positions the oil market for potential volatility as traders brace for changes in trade relationships.

Major Developments to Watch:

Market Movers: London-based mining giant Glencore has expressed interest in mergers and acquisitions to enhance shareholder value following delays with its copper merger with Rio Tinto. Meanwhile, UK oil major BP is nearing a deal to redevelop oil fields in Iraq’s Kirkuk region, aiming for a significant production boost.

Energy Initiatives: Trump declared a "national energy emergency" to expedite permits for oil and gas projects, reaffirming his campaign promise to cut energy prices dramatically within his first year. Analysts are keenly watching how these policies will unfold and impact global energy costs.

Geopolitical Factors: Yemen’s Houthi forces have announced a reduction in attacks on commercial vessels, which could stabilize freight costs amid ongoing conflicts in the region, providing relief to oil markets.

International Moves: As a bid to boost production, Libya plans to auction oil blocks requiring between $3 billion and $4 billion to reach pre-civil war production levels. Similarly, Iraq is modifying its budget to facilitate oil production negotiations in Kurdistan.

Environmental Impact: Despite Trump's rollback on green policies, China reported a record high in coal production, reaching 4.76 billion tonnes in 2024, underscoring the ongoing global reliance on fossil fuels amid environmental concerns.

With analysts predicting potential market fluctuations due to Trump’s reinstated energy policies and global unrest, the oil sector prepares for a year filled with uncertainty and opportunity. Will investors adapt to the changing landscape, or will volatility reign? Stay tuned as we unpack the implications of these developments!

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

Česko (CS)

Česko (CS)

대한민국 (KO)

대한민국 (KO)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)

الإمارات العربية المتحدة (AR)

الإمارات العربية المتحدة (AR)