Major Bankruptcy Sale: Tallahassee Exploration Inc. Assets Up for Grabs!

2025-03-17

Author: Sophie

Overview

On October 23, 2024, in a dramatic turn of events under the Bankruptcy and Insolvency Act (BIA), Tallahassee Exploration Inc. has officially entered receivership. This follows an application by the Orphan Well Association and the British Columbia Energy Regulator, leading to the appointment of PricewaterhouseCoopers Inc. LIT as the Receiver of the company.

Asset Details

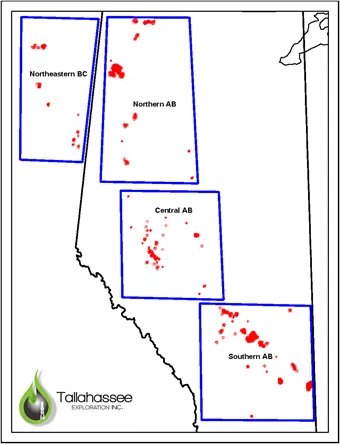

To facilitate the sale of Tallahassee’s oil and natural gas assets, Sayer Energy Advisors has stepped in as a strategic partner for the Receiver. These assets, known as the “Properties,” are strategically located across Alberta and British Columbia and consist of both operated and non-operated interests, which are categorized into distinct geographical packages: Southern Alberta, Central Alberta, Northern Alberta, and Northeastern British Columbia.

Background on Receivership

The company has faced serious challenges, particularly following a corporate abandonment order issued by the Alberta Energy Regulator (AER) on June 5, 2024. This order mandated Tallahassee to decommission their sites and create an approved reclamation plan. Consequently, all licensed properties have been in a shut-in state since June 2024, leading to a halt in production operations.

Production Potential

Although the properties are currently non-operational, they feature significant production potential. Before the shut-in, the average gross production capability was approximately 2,630 barrels of oil equivalent per day (boe/d), which includes 12.1 million cubic feet per day (MMcf/d) of natural gas alongside 611 barrels per day (bbl/d) of oil and natural gas liquids.

Bidding Information

Interested parties should take note: offers for these valuable assets are being accepted until 12:00 p.m. on Thursday, May 1, 2025. For those wishing to delve deeper into this opportunity, a comprehensive summary of the proposed divestiture has been prepared, with further confidential details available upon execution of a Confidentiality Agreement (attached for convenience).

Contact Information

For inquiries or further information, potential bidders are welcome to connect with Ben Rye, Sydney Birkett, or Tom Pavic at 403.266.6133.

Conclusion

Don’t miss out on this rare chance to acquire promising oil and gas assets in a recovering market—act fast!

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

Česko (CS)

Česko (CS)

대한민국 (KO)

대한민국 (KO)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)

الإمارات العربية المتحدة (AR)

الإمارات العربية المتحدة (AR)