Jupiter [JUP] Soars 62% in Volume – Will Bulls Maintain the Momentum?

2025-08-29

Author: Amelia

Jupiter's Recent Surge Raises Eyebrows

The cryptocurrency market is buzzing as Jupiter [JUP], the native token of a prominent decentralized exchange (DEX), experiences a notable surge. Amid a staggering 62.5% increase in daily trading volume, JUP has climbed 6.5% over the past 24 hours, signaling a wave of interest from investors. However, the question lingers: Can this momentum propel JUP into a sustainable uptrend?

Volatility and Resistance Levels

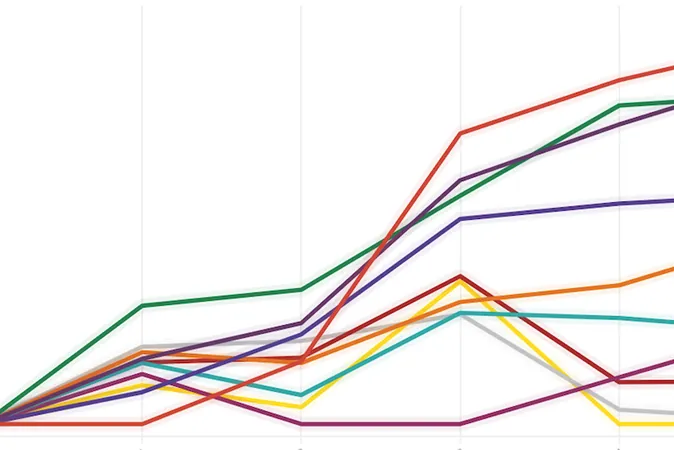

Traders are closely monitoring the liquidity around the $0.55 resistance level, which could trigger a minor price bounce. Yet, this bounce may not be sufficient to establish a lasting upward trend. Current indicators suggest that while there’s been a rebound in daily trading activity since mid-June, the price charts hint at a precarious balance between bulls and bears.

Active Addresses and Network Growth on the Rise

Recent data from Santiment reveals a slight uptick in Daily Active Addresses, indicating growing participation in the network. Additionally, the creation of new addresses has also surged, suggesting increased interest in JUP. Despite fluctuations in 7-day Weighted Sentiment—oscillating between bullish and bearish—there's a prevailing positive sentiment surrounding the token.

Technical Analysis: A Tug-of-War Begins

Examining the 1-day chart, JUP is currently trading within a long-term range marked between $0.33 and $0.63. The mid-point of this range at $0.48 has become a battleground for bulls and bears. Recent price action shows bears gaining the upper hand, with JUP closing at $0.454 on August 25, below the critical mid-range level.

Indicators Suggest Challenge Ahead for Bulls

Current indicators paint a cautious picture. The MACD is hovering near the zero line, failing to show definitive bullish momentum, while the Chaikin Money Flow (CMF) is at -0.07, indicating significant capital outflow. This combination hints that JUP bulls may face further challenges ahead.

Liquidation Zones Reveal Potential Price Moves

The liquidation map indicates that the $0.542-$0.548 range could be a critical area for price action, with a concentration of short liquidations possibly driving a bounce towards the $0.55 resistance. Conversely, long liquidations are clustered around the $0.48 level, suggesting that traders should be prepared for a possible dip followed by a bounce to $0.548.

The Bottom Line: Can Bulls Hold Strong?

As JUP navigates this volatile landscape, the upcoming levels of $0.48 and $0.55 will be crucial. Investors remain watchful, pondering whether bulls can defy the odds and maintain this upward momentum in the face of significant resistance.

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

Česko (CS)

Česko (CS)

대한민국 (KO)

대한민국 (KO)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)

الإمارات العربية المتحدة (AR)

الإمارات العربية المتحدة (AR)