Is OKB Set for a Breakout? Price Soars 35% in Just a Week!

2025-03-19

Author: Jacques

OKB's Price Surge

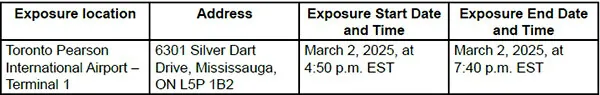

OKB, the native token of the prominent cryptocurrency exchange OKEx, has seen a remarkable increase of nearly 35% over the past week, recovering from a low of $38 on March 11. This swift upward movement has sparked speculation about whether OKB can break through the crucial resistance level of $52.05.

Market Structure and Buying Pressure

Despite the impressive weekly gains, OKB's overall market structure remains bearish. However, recent developments suggest that the bulls may be gearing up for a potential reversal.

Key indicators point toward strong buying pressure, with the On-Balance Volume (OBV) approaching local highs not seen since February, indicating that momentum is building in favor of the buyers. Additionally, the Relative Strength Index (RSI) has surged past the neutral mark of 50, which typically signifies a shift towards bullish momentum.

Technical Analysis and Future Targets

Technical analysis suggests that for a definitive bullish breakout, OKB needs to close above $52.05. A positive closure here could pave the way for further gains, with swing traders eyeing a subsequent target of $58. That said, traders should exercise caution; the ongoing volatility in Bitcoin's price could significantly impact OKB's performance, given that Bitcoin itself rose by approximately 7% over the same period.

Bearish Signals and Support Levels

However, as of now, some bearish signals are emerging. On the 4-hour chart, a notable bearish divergence has been detected between the Money Flow Index and OKB's price, indicating a potential retreat. This could lead to a drop to local support levels at $48 or, in a worst-case scenario, as low as $45.

Current Market Situation and Moving Forward

With Bitcoin witnessing a slight decline of 0.38% leading up to press time and OKB also experiencing a drop of 3.17%, traders could be wise to wait for a solid reaction from the $45-$48 support zone or a breakout above $52 before making any long positions.

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

Česko (CS)

Česko (CS)

대한민국 (KO)

대한민국 (KO)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)

الإمارات العربية المتحدة (AR)

الإمارات العربية المتحدة (AR)