Is Ethereum Poised for a Major Breakthrough After $3K Rejection?

2025-07-15

Author: Amelia

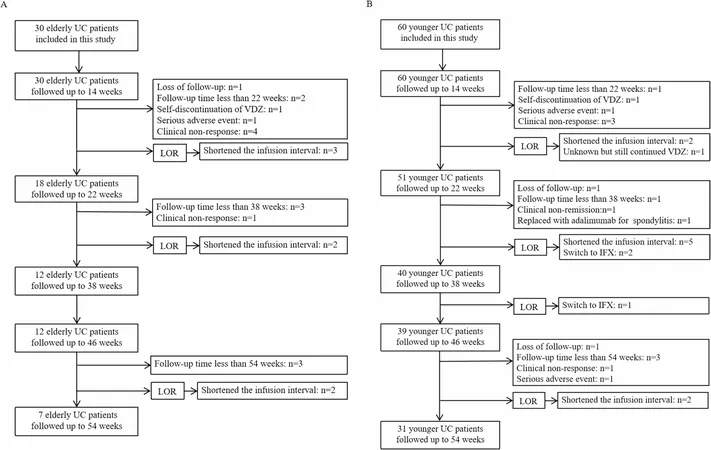

Ethereum's Recent Struggles: A 2% Dip and Liquidation Frenzy

Ethereum recently faced a significant setback, experiencing a 2% decline that triggered heavy liquidations. An astonishing $82.28 million in long positions were wiped out, representing nearly 80% of the day's total liquidations. However, even with this drop, Ethereum still boasts strong underlying support as reflected in Open Interest (OI) and surging ETF inflows.

A Surprising Resilience in Open Interest

Despite the market's volatile moves, Open Interest on Ethereum has remained relatively stable, dipping only 0.55% from its record high of $43.94 billion. This behavior is reminiscent of earlier patterns where stability in OI during consolidation led to explosive breakout rallies.

Spot ETF Inflows Surge!

Adding fuel to the fire, the past four trading days have seen an influx of approximately $260 million into spot Ethereum ETFs, bringing the total to nearly $1.1 billion. This represents the most robust performance since their launch last July. Clearly, large players are positioning for a significant move as the broader market remains uncertain.

Strategic Control Tightens: Who Holds the Supply?

For the first time, Ethereum's strategic reserves have surged past $4 billion, with just 50 entities now controlling 1.11% of the entire supply. Notably, BlackRock’s acquisition of 50,970 ETH, valued at around $150 million, is a strategic maneuver that cannot be overlooked. This may signal a deliberate shift of capital from Bitcoin to Ethereum.

The Battle of the Assets: Bitcoin vs. Ethereum

As Bitcoin struggles with resistance, showing a 3.72% drop in Open Interest and a 5% price decrease from its peak, Ethereum has exhibited relative strength. Its OI drawdown remains at a modest 2%, indicating better stability under pressure. If this trend continues, Ethereum could be setting the stage for a breakout above the coveted $3,000 mark.

What’s Next for Ethereum?

With strategic investments rolling in and market dynamics shifting, Ethereum seems to be at a pivotal moment. If the current momentum holds, this 2% dip could very well act as a launching pad for the next big breakout. Investors should keep a close watch as the signs suggest a potential surge is on the horizon!

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

Česko (CS)

Česko (CS)

대한민국 (KO)

대한민국 (KO)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)

الإمارات العربية المتحدة (AR)

الإمارات العربية المتحدة (AR)