Heart-Stopping Medical Bill in Florida? Ontario Man’s $620,000 Nightmare Finally Comes to an End!

2025-01-14

Author: Jacob

An Ontario man's relief over a covered medical bill

An Ontario man, Richard Bishop, can finally breathe a sigh of relief after his insurance company, Greenshield, agreed to cover the staggering $620,000 hospital bill incurred following a life-threatening cardiac arrest while he was in Florida. This decision has transformed the 74-year-old retiree's anxiety-ridden nights into peaceful slumber.

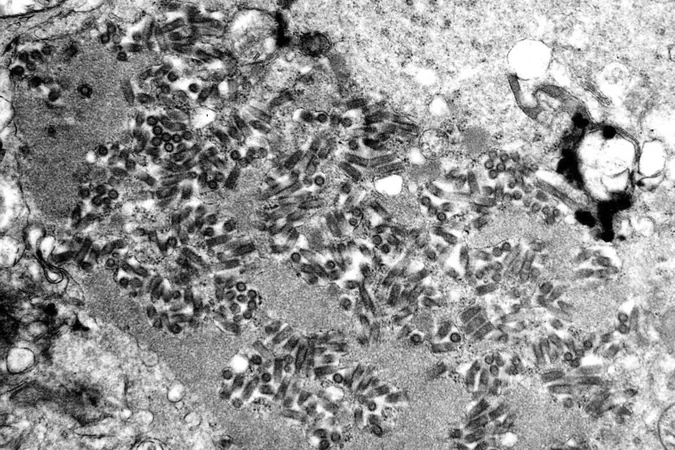

"I can’t believe it! It’s such a relief and takes away so many worries. I'll be able to sleep at night now,” expressed the Tecumseh resident. Bishop's ordeal began last March during a trip back home, when he collapsed at the Orlando airport, suffering cardiac arrest. Remarkably, it took medical personnel 14 grueling minutes of CPR to revive him.

Claims denial due to pre-existing conditions

Despite being equipped with travel medical insurance, Bishop was shocked to find out that his claim was denied due to pre-existing heart conditions, despite having received an $80,000 defibrillator during his hospital stay. “After you get an $80,000 defibrillator, they say, 'Oh, we’re not paying,’” he lamented.

Expert intervention leads to appeal

The case quickly caught the attention of travel insurance expert Martin Firestone, president of Travel Secure Inc. He volunteered to assist the Bishop family in appealing the insurance company's decision, which he noted was based on a lack of proper explanation regarding policy coverage at the time of purchase. “They were told that this retirement plan coverage was the best there is,” Firestone highlighted.

Negotiations result in a lower bill

With Firestone's guidance, the appeal process ultimately led Greenshield to settle the bill for a reduced amount of approximately $365,000. Firestone explained that such negotiations are common in the U.S. healthcare system, often resulting in lower costs for patients.

Gratitude for support

Bishop felt immense gratitude toward both CTV News for bringing attention to his plight and to Firestone for his support during this financial and emotional turmoil. “This is a major relief, and it turned out really good that they did pay,” he concluded.

Insurance company response and cautionary note for travelers

Greenshield, responding to inquiries about the claim, reiterated their commitment to the health and well-being of their members, emphasizing that complex claim decisions involve multiple levels of review.

As a cautionary note for travelers, Bishop's story serves as a vital reminder of the importance of understanding health insurance before heading out of the country, especially for those with existing medical conditions. Call your insurance provider, verify your coverage, and ensure you’re fully informed to avoid a financial disaster in a medical emergency!

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

Česko (CS)

Česko (CS)

대한민국 (KO)

대한민국 (KO)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)