Groundbreaking Lawsuit May Dismantle Trump’s Tariff Legacy and Revitalize the Stock Market!

2025-04-06

Author: Benjamin

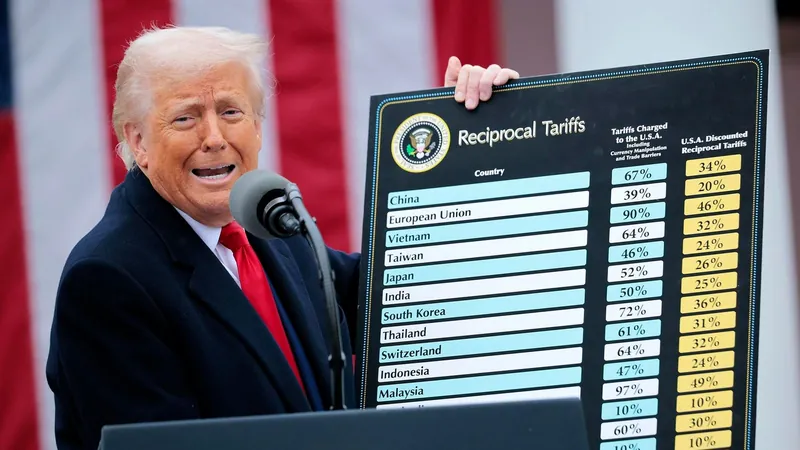

A significant legal battle is brewing that could potentially dismantle the sweeping tariffs imposed by the Trump administration, arguing that the use of emergency powers for such measures is unconstitutional. When Donald Trump initiated these expansive tariffs on international goods, he bypassed traditional trade laws, invoking the International Emergency Economic Powers Act (IEEPA) instead. This unprecedented approach may soon face legal scrutiny, as no U.S. president has ever employed this law to impose tariffs, making the current situation even more contentious.

The Financial Aftermath: A Wall Street Bloodbath

Since the enactment of these tariffs, particularly as they escalated on April 2, 2025, American consumers and businesses have felt the pinch of rising prices on a plethora of goods, which in turn spurred investor fears of stunted economic growth. The Wall Street Journal reported a staggering two-day market collapse, erasing a jaw-dropping $6.6 trillion in stock market value. 'President Trump put up a wall between the U.S. economy and the rest of the world, and the market tanked,' the report stated, reflecting widespread panic among investors.

China was among the first to retaliate, imposing its own tariffs on U.S. products, especially in agriculture. This retaliatory move placed immense pressure on the Trump administration to act swiftly, often turning to financial bailouts for affected American farmers, echoing a pattern seen in 2020—even though such spending came under scrutiny as Congress hadn't initially designated funds for this purpose.

The Controversial Use of Emergency Powers

Trump's justification for the tariffs hinged on declaring a national emergency—a claim that has raised eyebrows among legal experts. Under the IEEPA, the president can respond to 'unusual and extraordinary threats' to the economy, but critics argue that the IEEPA was never intended to authorize tariff impositions.

On April 3, 2025, the New Civil Liberties Alliance filed a lawsuit challenging this very use of power on behalf of a Florida-based company importing goods from China, claiming that the president is exceeding constitutional boundaries by bypassing Congress's authority to dictate tariffs.

The lawsuit outlines several compelling arguments why these tariffs may be illegitimate: 1. The IEEPA does not explicitly allow tariff implementation, making Trump's use of the act questionable. 2. Trump's executive orders, targeting China directly, might exceed the emergency basis required to justify such tariffs. 3. Potential violations of the non-delegation doctrine could arise if the IEEPA is interpreted to delegate tariff powers traditionally reserved for Congress. 4. Any adjustments to trade regulations under this act fail to comply with the proper legal protocols set by the Administrative Procedure Act.

Legal experts, including Georgetown law professor Kathleen Claussen, emphasize that this case may challenge the expansive nature of the declared emergency. Claussen argued that the IEEPA's vague terminology doesn’t justify tariffs and courts may perceive this as an overreach of executive power, potentially leading to a pivotal ruling.

What Lies Ahead?

Donald B. Cameron Jr., a senior trade counsel, expressed optimism about the merits of the lawsuit. He believes that if the court sides with the plaintiffs, it could mark a significant shift in executive versus congressional powers over tariffs—a topic likely to resonate deeply with political leaders as they navigate the complex landscape of U.S. trade policy.

While many speculate that Congress may take back its authoritative role over tariffs, there is hesitation, especially among Republican lawmakers who remain aligned with Trump’s policies. Should the lawsuit succeed, it could create a domino effect, challenging tariffs imposed on other nations, notably those from various global partners—not just China.

As this legal saga unfolds, the outcome could herald a dramatic change in U.S. trade policy, signaling relief for consumers and potential stabilization for the beleaguered stock market. Stay tuned as this high-stakes battle could redefine the future of American commerce!

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

Česko (CS)

Česko (CS)

대한민국 (KO)

대한민국 (KO)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)

الإمارات العربية المتحدة (AR)

الإمارات العربية المتحدة (AR)