CN Rail Suffers Major Downgrades as Analysts React to Dismal Quarterly Results

2025-07-23

Author: Liam

Analysts' Shockwave Hits CN Rail

In an unsettling turn of events, Canadian National Railway (CNR-T) finds itself at the center of analyst scrutiny following a disappointing quarterly report and the abrupt withdrawal of its forward guidance. Shares plummeted over 4% at the opening in Toronto, landing at C$131.

Target Prices Slashed Across the Board

Multiple analysts have issued severe downgrades in response to the company's revised outlook:

- **ATB Capital Markets:** Price target reduced to C$150 from C$155, maintaining a 'sector perform' rating.

- **JP Morgan:** Downgraded its target to C$154 from C$163 and shifted its rating from 'overweight' to 'neutral'.

- **National Bank of Canada:** Reduced its target to C$150 from C$170, downgrading the stock from 'outperform' to 'sector perform'.

- **Scotiabank:** Adjusted its target to C$153 from C$165, reiterating a 'sector outperform' rating.

- Other notable cuts include TD Cowen to C$165, BMO to C$163, and RBC to C$157.

Is CN Rail's Outlook Gloomy?

Despite achieving revenues of $4.272 billion—just shy of expectations of $4.337 billion—concerns over CN's revised forecasts have sent shockwaves through the investment community. The railway has lowered its EPS growth outlook for 2025 to mid-to-high single digits, abandoning its previous guidance of 10-15% growth.

National Bank's analyst Cameron Doerksen noted, "Current consensus growth for 2025 sits at 9%, which starkly contrasts the earlier target. This new guidance is poised to cause further disappointment among investors."

Factors Behind the Downgrade

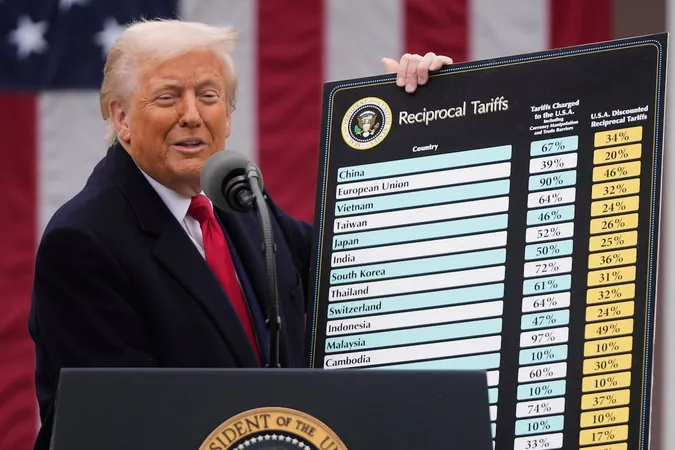

CN attributes its conservative outlook largely to uncertainties surrounding trade and tariffs. The railway's performance has been impacted by a decline in Revenue Ton Miles (RTM)—down 6.5% year-over-year. Initial expectations have been adjusted, now estimating modest growth in RTM.

Market Analysts Split on Future Outlook

Despite the gloomy projections, some analysts maintain a positive stance on CN Rail. TD's Cherilyn Radbourne believes that while shares may have suffered, their current value compared to peers could limit further sell-off risks. Similarly, Raymond James remains optimistic based on a growing trade outlook and improved network efficiency.

"We recommend shares of CN given its attractive valuation, despite ongoing macroeconomic uncertainties," stated analyst Steve Hansen.

Executive Shakeup at CN Rail

Amidst the turmoil, CN Rail has also announced a significant shift in its executive team. Remi G. Lalonde has departed as chief commercial officer, with Janet Drysdale stepping in as interim.

Scotiabank's Konark Gupta sees this change positively, suggesting it may signal a buying opportunity for investors. "We find value at these levels for a crucial asset facing transient challenges," he commented.

Other Market Movers

In addition to CN Rail, several companies have seen shifts in their stock outlooks as analysts recalibrate targets. For example, Jefferies raised its target price on Enbridge Inc to C$72 from C$65, signaling confidence in its growth potential.

As markets react to these developments, investors remain on high alert for further insights into CN Rail's trajectory and the broader economic landscape.

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

Česko (CS)

Česko (CS)

대한민국 (KO)

대한민국 (KO)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)

الإمارات العربية المتحدة (AR)

الإمارات العربية المتحدة (AR)