Analysts Adjust Ratings Amid Consumer Concerns and Tariff Uncertainty

2025-04-28

Author: Benjamin

Expert Insights into the Market Trends

As earnings season heats up, analysts are sharpening their pencils and adjusting their ratings. Scotia Capital's Kevin Krishnaratne is particularly cautious about stocks tied to consumer trends, advising investors to consider more resilient companies. He highlighted DSGX and KXS, which could benefit from supply chain uncertainties, as well as health tech firms VHI and WELL for their robust foundations.

Lightspeed Commerce Faces Downgrade

In a strategic move, Krishnaratne downgraded Lightspeed Commerce Inc. from `sector outperform` to `sector perform`, citing an expected decline in subscription revenue due to a weakening small-to-medium business landscape. He predicts an underwhelming Q4, projecting only a modest recovery in the latter half of the fiscal year, with his price target dropping from $17 to $11.

Railroad and Real Estate Giants Struggle

Dye & Durham also saw its target lowered from $20 to $18 amid concerns over the slowing Canadian real estate market. Recent revisions suggest zero growth in housing for 2025, triggering a cautious approach. Similarly, Open Text Corporation's outlook shifted downward, lowering its price target to $30 due to a lack of short-term growth catalysts.

Shopify's Dropshipping Dilemma

Analysts have also expressed concerns about Shopify, downgrading its price from $120 to $90. With potential tariff changes impacting the dropshipping sector, the company's gross merchandise volume projections have been slashed. Factors such as consumer reliance on China for sourcing could spell trouble for smaller businesses focused solely on dropshipping.

Lululemon's Global Challenges

Citi analyst Paul Lejuez trimmed his earnings forecast for Lululemon Athletica, citing the ongoing trend of weaker consumer demand combined with tariff challenges. His revised estimates for 2025 and 2026 earnings per share suggest a downturn in key markets, leading him to narrow the target from $375 to $330.

Aritzia Remains a Strong Contender

Despite uncertainties, RBC Dominion Securities analyst Irene Nattel remains optimistic about Aritzia Inc., adjusting her earnings predictions slightly downward while maintaining a constructive view. With solid sales trends expected, Aritzia releases its Q4 results soon, making it a company to watch.

Boyd Group Faces Repair Industry Slowdown

Analysts are keeping a close eye on Boyd Group Service’s performance as industry trends indicate a slowdown, especially in repair claims. Target prices for Boyd have been adjusted in anticipation of tougher market conditions.

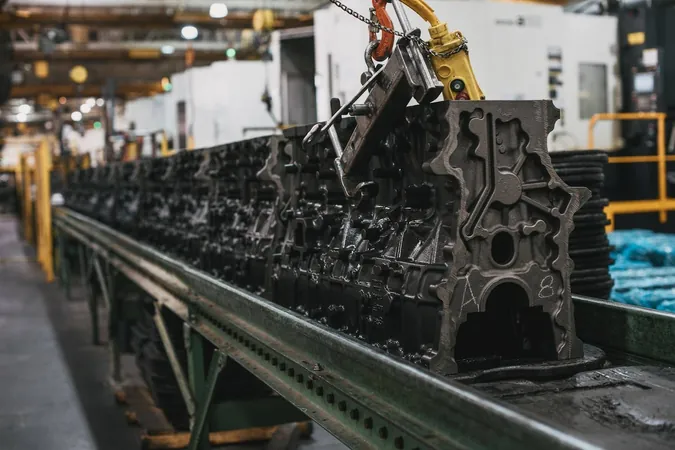

The Auto Parts Sector Faces Tariff Turmoil

TD Cowen's Brian Morrison suggests that Canada's auto parts suppliers may be facing volatility in light of potential tariffs, leading to cautious projections for near-term performance.

Final Thoughts for Investors

As uncertainty looms within the retail and consumer markets, analysts are urging caution. The looming impacts of tariffs, changing consumer behavior, and weakening sales trends are influencing target price adjustments across the board. Investors are recommended to stay informed and consider defensive options amid shifting market dynamics.

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

Česko (CS)

Česko (CS)

대한민국 (KO)

대한민국 (KO)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)

الإمارات العربية المتحدة (AR)

الإمارات العربية المتحدة (AR)