All Eyes on the Fed: What to Expect Today

2025-05-07

Author: Charlotte

Today is a pivotal day for the Federal Reserve as it prepares to unveil its latest decision on interest rates at 2 PM ET, followed by a press conference with Fed Chair Jerome Powell at 2:30 PM ET. With no rate change anticipated, all attention will be on their forward guidance and how they plan to navigate ongoing economic uncertainties.

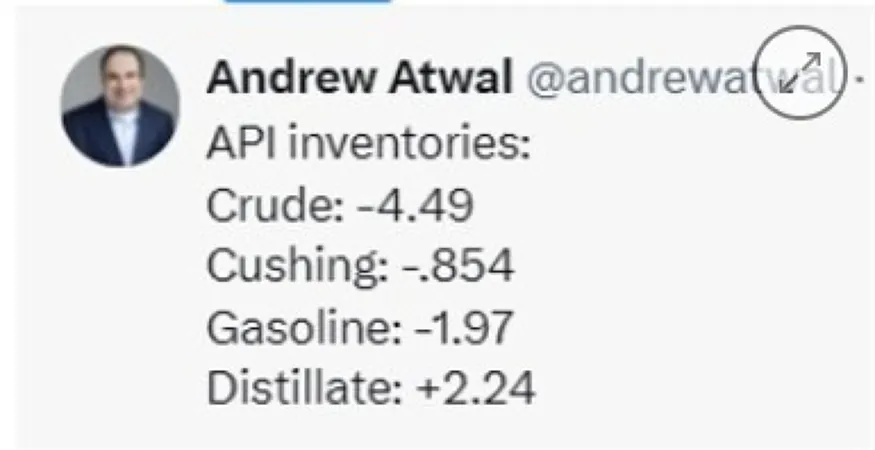

While the economic calendar appears light in North America today—highlighted only by the weekly release of inventory data from the Energy Information Administration—investors are poised for insights from the Fed that could shape financial markets moving forward. Expectation for crude oil inventories is a drawdown of 0.833 million barrels, gasoline at a decline of 1.6 million barrels, and distillates down 1.271 million barrels.

The looming tariffs present a significant backdrop, as their full impact on growth and inflation remains largely unknown. The Fed has adopted a cautious 'wait and see' strategy, which has been effective thus far as the economy shows resilience despite soft data signals.

Job market indicators are looking robust, with initial jobless claims data being closely monitored this week. The consensus is that while there are signs of weakness in softer data, key metrics still suggest stability. Market participants are currently pricing in a 30% likelihood of a rate cut in the upcoming June meeting.

As part of the financial landscape, the Treasury auction saw strong demand for three-year and ten-year notes earlier this week, but in an effort to sidestep volatility surrounding the Fed's decision, the auction for 30-year bonds has been postponed until tomorrow at 1 PM.

In a positive response to ongoing U.S.-China trade discussions, U.S. stocks are showing modest gains in premarket trading, with the S&P 500 up by 19.34 points. Short-term yields are also on the rise, with two-year bonds up by 2.5 basis points, while the 30-year bond sees a slight decrease of 1.9 basis points.

Later today, consumer credit figures are set to be released at 3 PM, projecting a $9.50 billion increase following a slight downturn of $0.81 billion in the previous month. All eyes remain glued to the Fed's unveiling, as their decision could very well steer the economic narrative in the days to come.

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

Česko (CS)

Česko (CS)

대한민국 (KO)

대한민국 (KO)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)

الإمارات العربية المتحدة (AR)

الإمارات العربية المتحدة (AR)